Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are trying to compare the interest rate risks of two bonds: (i) a 15-year 8% bond, and (ii) a 10-year 6% bond. Both

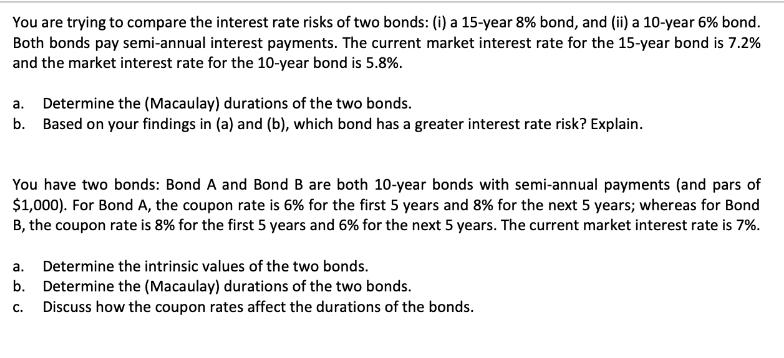

You are trying to compare the interest rate risks of two bonds: (i) a 15-year 8% bond, and (ii) a 10-year 6% bond. Both bonds pay semi-annual interest payments. The current market interest rate for the 15-year bond is 7.2% and the market interest rate for the 10-year bond is 5.8%. a. Determine the (Macaulay) durations of the two bonds. b. Based on your findings in (a) and (b), which bond has a greater interest rate risk? Explain. You have two bonds: Bond A and Bond B are both 10-year bonds with semi-annual payments (and pars of $1,000). For Bond A, the coupon rate is 6% for the first 5 years and 8% for the next 5 years; whereas for Bond B, the coupon rate is 8% for the first 5 years and 6% for the next 5 years. The current market interest rate is 7%. a. Determine the intrinsic values of the two bonds. b. Determine the (Macaulay) durations of the two bonds. C. Discuss how the coupon rates affect the durations of the bonds.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a The Macaulay duration of a bond is a measure of its interest rate risk It is calculated as the wei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started