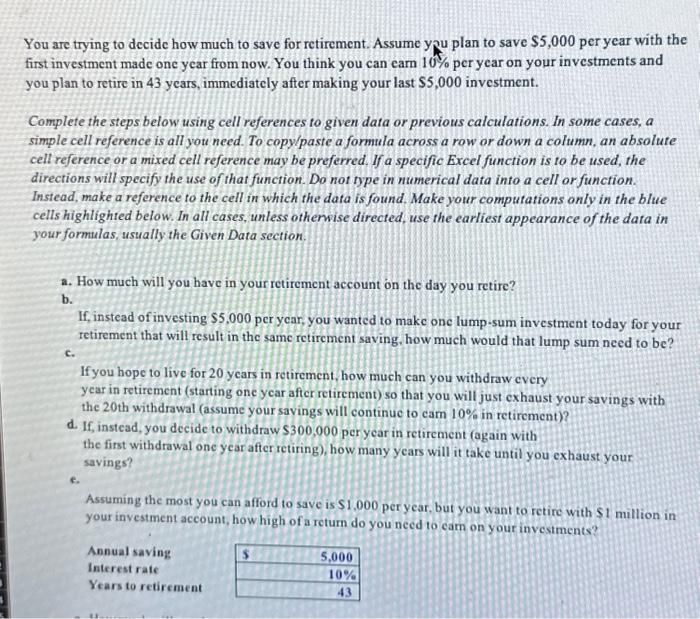

You are trying to decide how much to save for retirement. Assume you plan to save $5,000 per year with the first investment made one year from now. You think you can earn 10% per year on your investments and you plan to retire in 43 years, immediately after making your last $5,000 investment. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $5,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? If you hope to live for 20 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 20th withdrawal (assume your savings will continue to carn 10% in retirement)? d. If, instead, you decide to withdraw $300,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it take until you exhaust your savings? e. Assuming the most you can afford to save is $1,000 per year, but you want to retire with $1 million in your investment account, how high of a return do you need to earn on your investments? Annual saving Interest rate Years to retirement S 5,000 10% 43

*need the formulas for each box

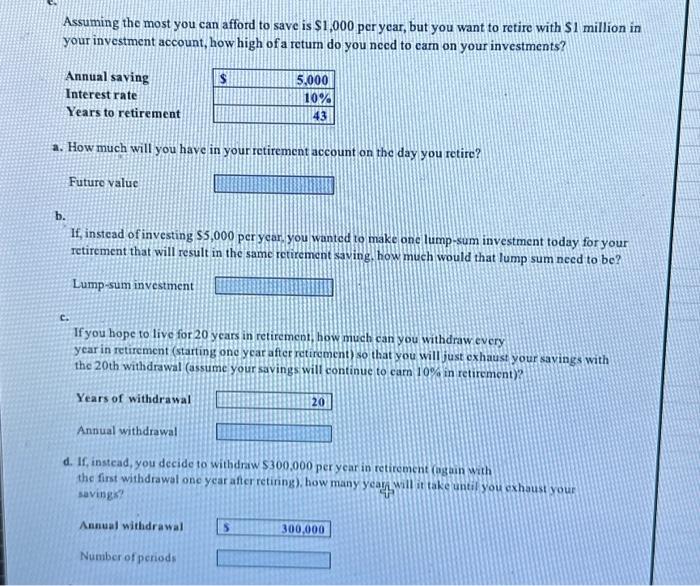

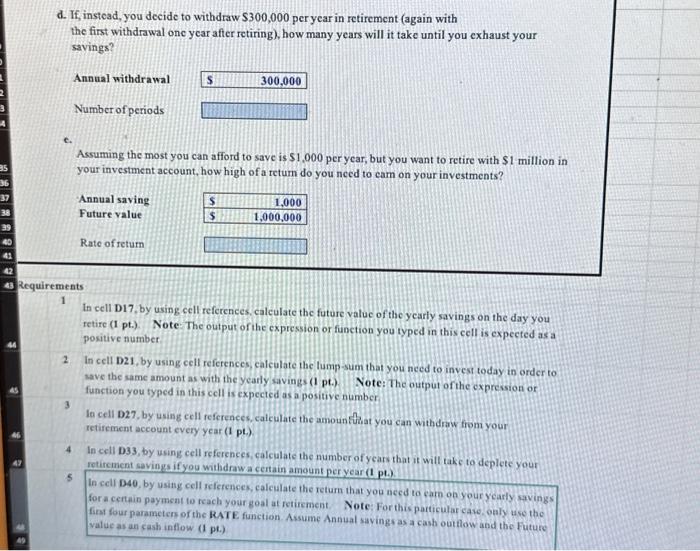

You are trying to decide how much to save for retirement. Assume y p plan to save $5,000 per year with the first investment made one year from now. You think you can earn 10% per year on your investments and you plan to retire in 43 years, immediately after making your last $5,000 investment. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $5,000 per ycar, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? c. If you hope to live for 20 years in retirement, how much can you withdraw every year in retirement (starting one ycar after retirement) so that you will just exhaust your savings with the 20 th withdrawal (assume your savings will continue to cam 10% in retirement)? d. If, instead, you decide to withdraw $300,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it take until you exhaust your savings? e. Assuming the most you can afford to save is $1.000 per year, but you want to retire with $1 million in your investment account, how high of a return do you need to cam on your investments? Assuming the most you can afford to save is $1,000 per year, but you want to retire with $1 million in your investment account, how high of a retum do you necd to cam on your investments? a. How much will you have in yourtetirement account on the day you retire? Future valuc b. If, instead of investing \$5,000 per y car you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving. how much would that lump sum need to be? Lump-sum investment c. If you hope to live for 20 years in retirement, how much can you withdrawevery year in retirement (starting one ycar after retirement) so that you will just cxhaust your savings with the 20 th withdrawal (assume your savings will continue to carn 10 in retircment)? Years of withdrawal Annual withdrawal d. If, instead, you decide to withdraw 5300,000 per year in retirement cogain with the first withdrawal one year after retinng), how many ycar will it take until you cxhaust your savings? Annual withdrawal Number of periods d. If, instead, you decide to withdraw $300,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it take until you exhaust your savings? Annual withdrawal Number of periods c. Assuming the most you can afford to save is $1,000 per ycar, but you want to retire with $1 million in your investment account, how high of a retum do you need to cam on your investments? Annual saving Future value Rate of retum irements 1 In cell D17, by using cell references, calculate the future value of the yearly savings on the day you retire (1 pt.). Note. The output or ihe expression or function you typed in this cell is expected as a positive number 2 In cell D21, by using cell references, calculate the tump-sum that you necd to invest today in order to save the same amount as with the yearly savings (1 pt.) Note: The output of the cxpression or function you typed in this cell is expected as a positive number 3 Ia cell D27, by using cell references, calculate the amountuat you can withdraw from your retifement account every year (1 pt.). 4 In cell D33, by using cell references, calculate the number of ycars that it will take to deplete your retircment savings if you withdraw a certain amount per year (1 pt). 5 In cell D40, by using cell references, calculate the return that you necd to caro on your ycarly savings for a certain paymeat to reach your goal at retirment. Note: For this particular case. oaly use the firs four parameters of the RATE. function. Assume Annual savings as a casb out flow and the Future value as an cash inflow (A ph.)