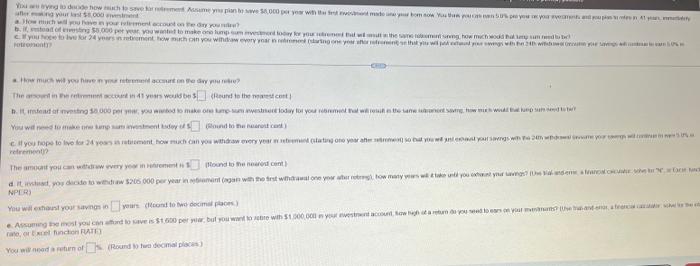

You are trying to decide how much to save kar neement Assume you plan to save $8,000 per year with the fest vist madoune your bom now You them poucas en 50% pe you your event and open 41 afering your last $8,000 How much will you have in your element account on the day you? b. if, vestead of evesting 50,000 per year you wanted to make one lump sum investment today for your strened that we will the same toment seng, how much wodd hat lengsum need to b If you hope to ve for 24 years in retirement how much in windiaw every year in rebrement (tarting one year after refroment se that yie wil poked your swegs with be 24h with your ago 0% How much wit you have in your retrement account on the day you re The around in the retrement account in 41 years would be 3 (Round to the east cont b. It mead of investing 50 000 per year, you wanted to make one tump-sum investere today for your rebrement that will the same wonent sag how much will that up sud You will need to make one kamp sum investment today of sound to the nearest cant) e if you hope to live for 24 years in retirement how much can you withdraw every year seemed (starting one year after some so but you just east your savings with the 20 me your own retrement? The amount you can withdraw every year in trement is sound to the neared cent) dit ind, you decide to withdraw $205 000 per year in retament (again with the first withdrawal one year after retrg), how many years wake und you on your savings? (the landema anche c NPER) You will exhaust your savings in yours (Moond to two decimal places) Assuming the most you can afford to save is $1.500 per year, but you want to sobre with $1,000,000 in your investment account, Bow high at a return do you need to ears on your mats? (the hand enor, a francia catat she rate, or Excel function RATE) You will need a return of (Round to two decimal places) You are trying to decide how much to save kar neement Assume you plan to save $8,000 per year with the fest vist madoune your bom now You them poucas en 50% pe you your event and open 41 afering your last $8,000 How much will you have in your element account on the day you? b. if, vestead of evesting 50,000 per year you wanted to make one lump sum investment today for your strened that we will the same toment seng, how much wodd hat lengsum need to b If you hope to ve for 24 years in retirement how much in windiaw every year in rebrement (tarting one year after refroment se that yie wil poked your swegs with be 24h with your ago 0% How much wit you have in your retrement account on the day you re The around in the retrement account in 41 years would be 3 (Round to the east cont b. It mead of investing 50 000 per year, you wanted to make one tump-sum investere today for your rebrement that will the same wonent sag how much will that up sud You will need to make one kamp sum investment today of sound to the nearest cant) e if you hope to live for 24 years in retirement how much can you withdraw every year seemed (starting one year after some so but you just east your savings with the 20 me your own retrement? The amount you can withdraw every year in trement is sound to the neared cent) dit ind, you decide to withdraw $205 000 per year in retament (again with the first withdrawal one year after retrg), how many years wake und you on your savings? (the landema anche c NPER) You will exhaust your savings in yours (Moond to two decimal places) Assuming the most you can afford to save is $1.500 per year, but you want to sobre with $1,000,000 in your investment account, Bow high at a return do you need to ears on your mats? (the hand enor, a francia catat she rate, or Excel function RATE) You will need a return of (Round to two decimal places)