Answered step by step

Verified Expert Solution

Question

1 Approved Answer

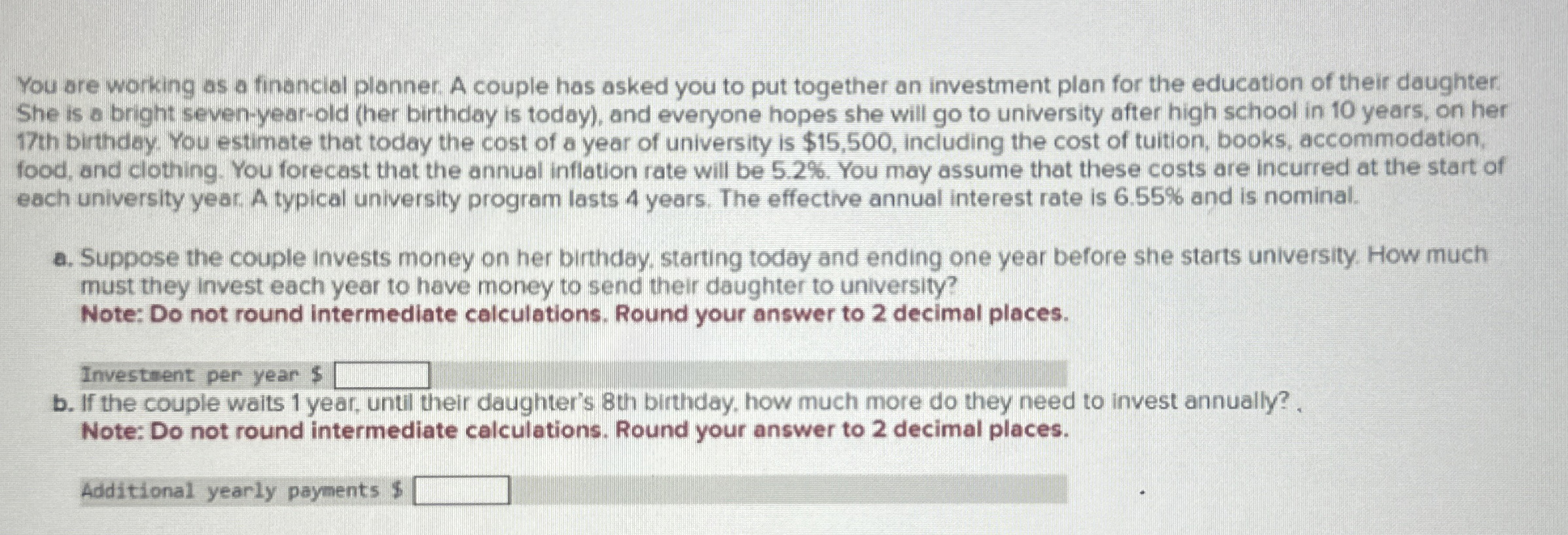

You are working as a financial plonner. A couple has asked you to put together an investment plan for the education of their daughter. She

You are working as a financial plonner. A couple has asked you to put together an investment plan for the education of their daughter.

She is a bright sevenyearold her birthday is today and everyone hopes she will go to university after high school in years, on her

th blithday. You estimate that today the cost of a year of university is $ including the cost of tuition, books, accommodation,

food, and clothing. You forecast that the annual inflation rate will be You may assume that these costs are incurred at the start of

each university year. A typical university program lasts years. The effective annual interest rate is and is nominal.

a Suppose the couple invests money on her birthday. starting today and ending one year before she starts university. How much

must they invest each year to have money to send their daughter to university?

Note: Do not round intermediate calculations. Round your answer to decimal places.

Investment per year $

b If the couple waits year, until their daughter's th birthday, how much more do they need to invest annually?

Note: Do not round intermediate calculations. Round your answer to decimal places.

Additional yearly payments $P

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started