Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are working as an investment analyst with Felix Hype Incorporation (FHI) which is a data storage provided. FHI has reported the following results

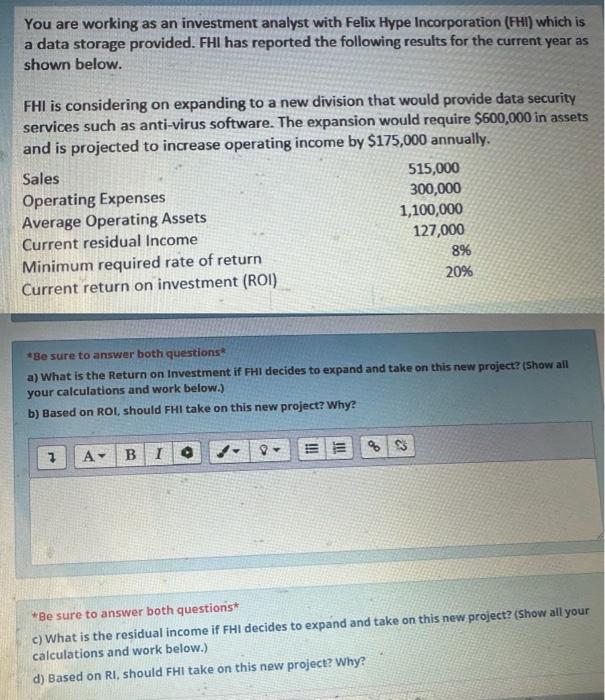

You are working as an investment analyst with Felix Hype Incorporation (FHI) which is a data storage provided. FHI has reported the following results for the current year as shown below. FHI is considering on expanding to a new division that would provide data security services such as anti-virus software. The expansion would require $600,000 in assets and is projected to increase operating income by $175,000 annually. Sales Operating Expenses Average Operating Assets Current residual Income Minimum required rate of return Current return on investment (ROI) 515,000 300,000 1,100,000 127,000 8% 20% *Be sure to answer both questions a) What is the Return on Investment if FHI decides to expand and take on this new project? (Show all your calculations and work below.) b) Based on ROI, should FHI take on this new project? Why? A B I 855 *Be sure to answer both questions* c) What is the residual income if FHI decides to expand and take on this new project? (Show all your calculations and work below.) d) Based on RI, should FHI take on this new project? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the Return on Investment ROI we use the formula ROI Operating ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started