Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are working in the accounting department of a manufacturing organization. The executives are exploring how to finance a new venture, a new product line,

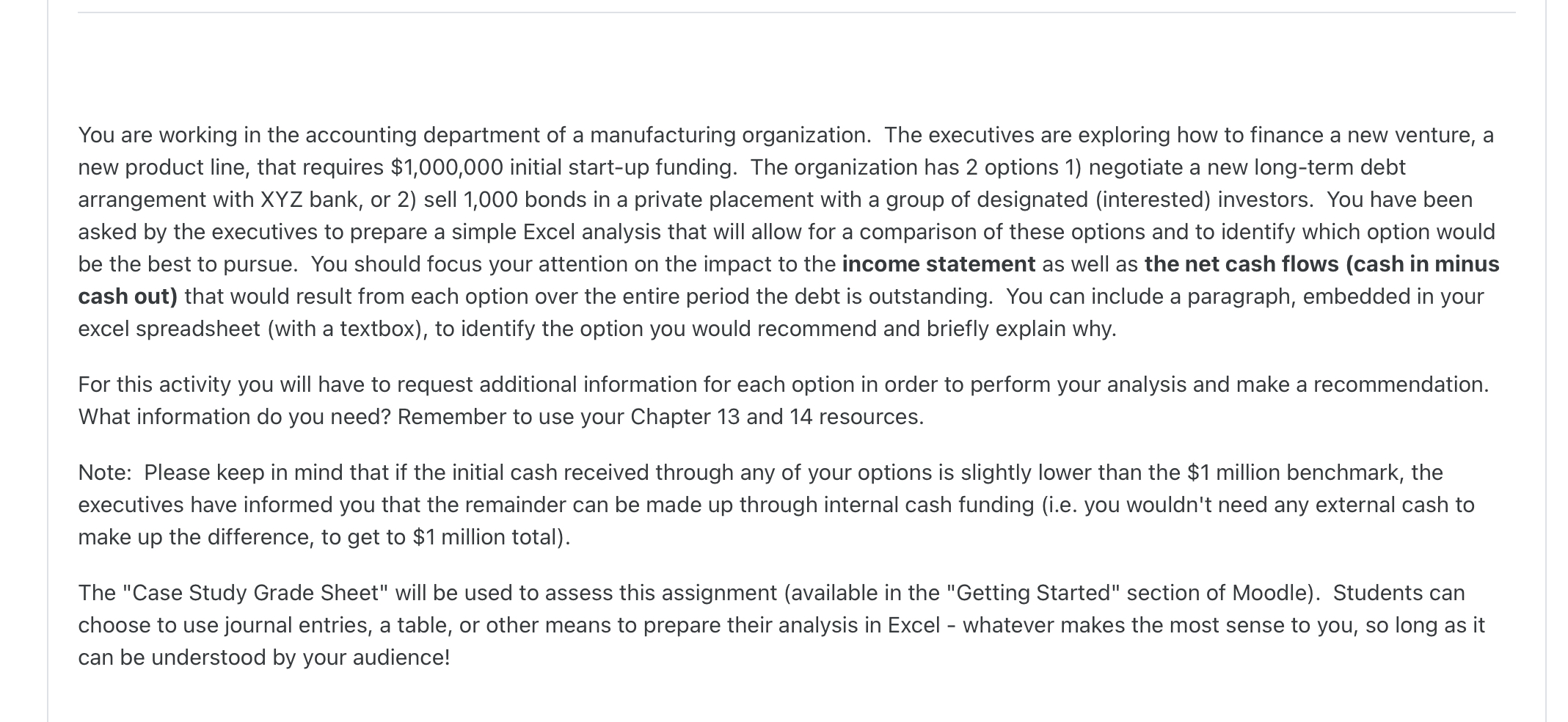

You are working in the accounting department of a manufacturing organization. The executives are exploring how to finance a new venture, a

new product line, that requires $ initial startup funding. The organization has options negotiate a new longterm debt

arrangement with XYZ bank, or sell bonds in a private placement with a group of designated interested investors. You have been

asked by the executives to prepare a simple Excel analysis that will allow for a comparison of these options and to identify which option would

be the best to pursue. You should focus your attention on the impact to the income statement as well as the net cash flows cash in minus

cash out that would result from each option over the entire period the debt is outstanding. You can include a paragraph, embedded in your

excel spreadsheet with a textbox to identify the option you would recommend and briefly explain why.

For this activity you will have to request additional information for each option in order to perform your analysis and make a recommendation.

What information do you need? Remember to use your Chapter and resources.

Note: Please keep in mind that if the initial cash received through any of your options is slightly lower than the $ million benchmark, the

executives have informed you that the remainder can be made up through internal cash funding ie you wouldn't need any external cash to

make up the difference, to get to $ million total

The "Case Study Grade Sheet" will be used to assess this assignment available in the "Getting Started" section of Moodle Students can

choose to use journal entries, a table, or other means to prepare their analysis in Excel whatever makes the most sense to you, so long as it

can be understood by your audience!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started