Answered step by step

Verified Expert Solution

Question

1 Approved Answer

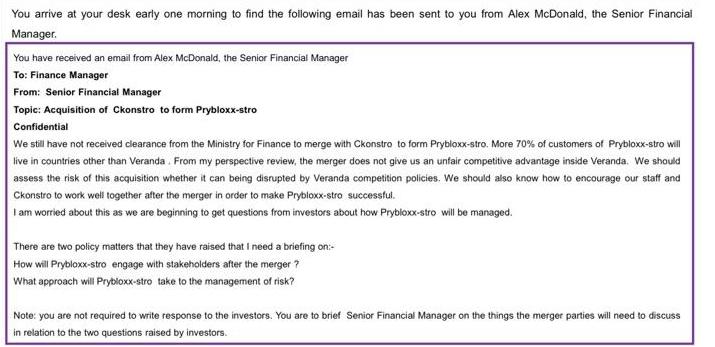

You arrive at your desk early one morning to find the following email has been sent to you from Alex McDonald, the Senior Financial

You arrive at your desk early one morning to find the following email has been sent to you from Alex McDonald, the Senior Financial Manager. You have received an email from Alex McDonald, the Senior Financial Manager To: Finance Manager From: Senior Financial Manager Topic: Acquisition of Ckonstro to form Prybloxx-stro Confidential We still have not received clearance from the Ministry for Finance to merge with Ckonstro to form Prybloxx-stro. More 70% of customers of Prybloxx-stro will live in countries other than Veranda. From my perspective review, the merger does not give us an unfair competitive advantage inside Veranda. We should assess the risk of this acquisition whether it can being disrupted by Veranda competition policies. We should also know how to encourage our staff and Ckonstro to work well together after the merger in order to make Prybloxx-stro successful. I am worried about this as we are beginning to get questions from investors about how Prybloxx-stro will be managed. There are two policy matters that they have raised that I need a briefing on:- How will Prybloxx-stro engage with stakeholders after the merger? What approach will Prybloxx-stro take to the management of risk? Note: you are not required to write response to the investors. You are to brief Senior Financial Manager on the things the merger parties will need to discuss in relation to the two questions raised by investors. You arrive at your desk early one morning to find the following email has been sent to you from Alex McDonald, the Senior Financial Manager. You have received an email from Alex McDonald, the Senior Financial Manager To: Finance Manager From: Senior Financial Manager Topic: Acquisition of Ckonstro to form Prybloxx-stro Confidential We still have not received clearance from the Ministry for Finance to merge with Ckonstro to form Prybloxx-stro. More 70% of customers of Prybloxx-stro will live in countries other than Veranda. From my perspective review, the merger does not give us an unfair competitive advantage inside Veranda. We should assess the risk of this acquisition whether it can being disrupted by Veranda competition policies. We should also know how to encourage our staff and Ckonstro to work well together after the merger in order to make Prybloxx-stro successful. I am worried about this as we are beginning to get questions from investors about how Prybloxx-stro will be managed. There are two policy matters that they have raised that I need a briefing on:- How will Prybloxx-stro engage with stakeholders after the merger? What approach will Prybloxx-stro take to the management of risk? Note: you are not required to write response to the investors. You are to brief Senior Financial Manager on the things the merger parties will need to discuss in relation to the two questions raised by investors.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Prybloxxstro will need to discuss the following matters in relation to engagement with stakeh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started