Answered step by step

Verified Expert Solution

Question

1 Approved Answer

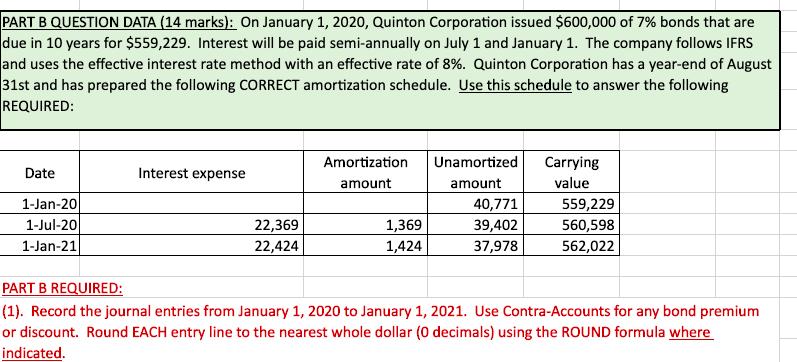

PART B QUESTION DATA (14 marks): On January 1, 2020, Quinton Corporation issued $600,000 of 7% bonds that are due in 10 years for

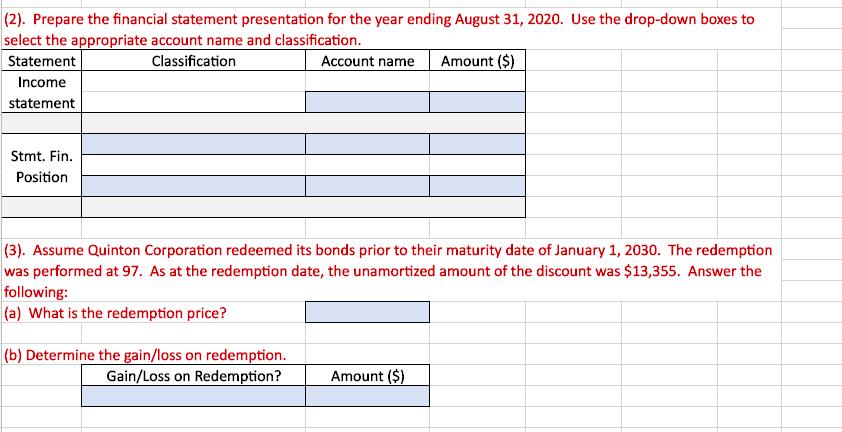

PART B QUESTION DATA (14 marks): On January 1, 2020, Quinton Corporation issued $600,000 of 7% bonds that are due in 10 years for $559,229. Interest will be paid semi-annually on July 1 and January 1. The company follows IFRS and uses the effective interest rate method with an effective rate of 8%. Quinton Corporation has a year-end of August 31st and has prepared the following CORRECT amortization schedule. Use this schedule to answer the following REQUIRED: Date 1-Jan-20 1-Jul-20 1-Jan-21 Interest expense 22,369 22,424 Amortization amount 1,369 1,424 Unamortized amount 40,771 39,402 37,978 Carrying value 559,229 560,598 562,022 PART B REQUIRED: (1). Record the journal entries from January 1, 2020 to January 1, 2021. Use Contra-Accounts for any bond premium or discount. Round EACH entry line to the nearest whole dollar (0 decimals) using the ROUND formula where indicated. Date Jan. 1/20 Issuance Jul. 1/20 P1 Cash P2 *ROUND Each line* Cash Aug. 31/20 Year-end *ROUND Each line* Interest Payable Jan. 1/21 Interest Expense Account Title Cash Debit Credit 21,000 (2). Prepare the financial statement presentation for the year ending August 31, 2020. Use the drop-down boxes to select the appropriate account name and classification. Classification Account name Amount ($) Statement Income statement Stmt. Fin. Position (3). Assume Quinton Corporation redeemed its bonds prior to their maturity date of January 1, 2030. The redemption was performed at 97. As at the redemption date, the unamortized amount of the discount was $13,355. Answer the following: (a) What is the redemption price? (b) Determine the gain/loss on redemption. Gain/Loss on Redemption? Amount ($)

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started