Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can answer according to required A company started its business in December. Data regarding its first month of operations until the year-end are as

you can answer according to required

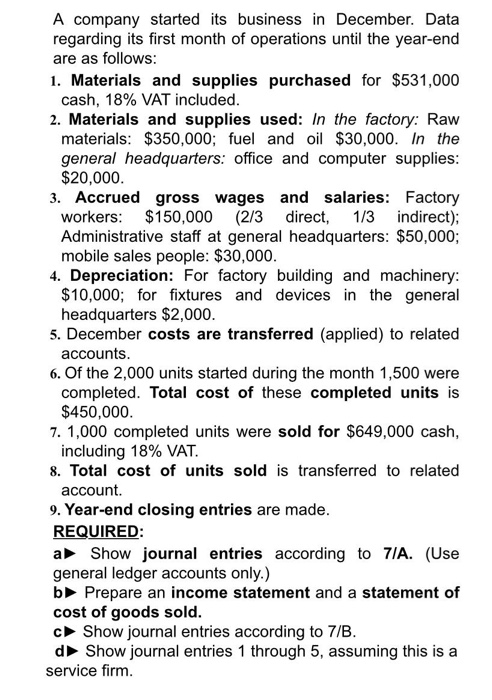

A company started its business in December. Data regarding its first month of operations until the year-end are as follows: 1. Materials and supplies purchased for $531,000 cash, 18% VAT included. 2. Materials and supplies used: In the factory: Raw materials: $350,000; fuel and oil $30,000. In the general headquarters: office and computer supplies: $20,000. 3. Accrued gross wages and salaries: Factory workers: $150,000 (2/3 direct, 1/3 indirect); Administrative staff at general headquarters: $50,000; mobile sales people: $30,000. 4. Depreciation: For factory building and machinery: $10,000; for fixtures and devices in the general headquarters $2,000. 5. December costs are transferred (applied) to related accounts. 6. Of the 2,000 units started during the month 1,500 were completed. Total cost of these completed units is $450,000. 7. 1,000 completed units were sold for $649,000 cash, including 18% VAT. 8. Total cost of units sold is transferred to related account 9. Year-end closing entries are made. REQUIRED: a Show journal entries according to 7/A. (Use general ledger accounts only.) b Prepare an income statement and a statement of cost of goods sold. c Show journal entries according to 7/B. d Show journal entries 1 through 5, assuming this is a service firm. A company started its business in December. Data regarding its first month of operations until the year-end are as follows: 1. Materials and supplies purchased for $531,000 cash, 18% VAT included. 2. Materials and supplies used: In the factory: Raw materials: $350,000; fuel and oil $30,000. In the general headquarters: office and computer supplies: $20,000. 3. Accrued gross wages and salaries: Factory workers: $150,000 (2/3 direct, 1/3 indirect); Administrative staff at general headquarters: $50,000; mobile sales people: $30,000. 4. Depreciation: For factory building and machinery: $10,000; for fixtures and devices in the general headquarters $2,000. 5. December costs are transferred (applied) to related accounts. 6. Of the 2,000 units started during the month 1,500 were completed. Total cost of these completed units is $450,000. 7. 1,000 completed units were sold for $649,000 cash, including 18% VAT. 8. Total cost of units sold is transferred to related account 9. Year-end closing entries are made. REQUIRED: a Show journal entries according to 7/A. (Use general ledger accounts only.) b Prepare an income statement and a statement of cost of goods sold. c Show journal entries according to 7/B. d Show journal entries 1 through 5, assuming this is a service firm Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started