Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can do journal entry according to requirements Inventories of a manufacturing firm at the beginning of March are as follows: Materials and supplies: 12,400,000

you can do journal entry according to requirements

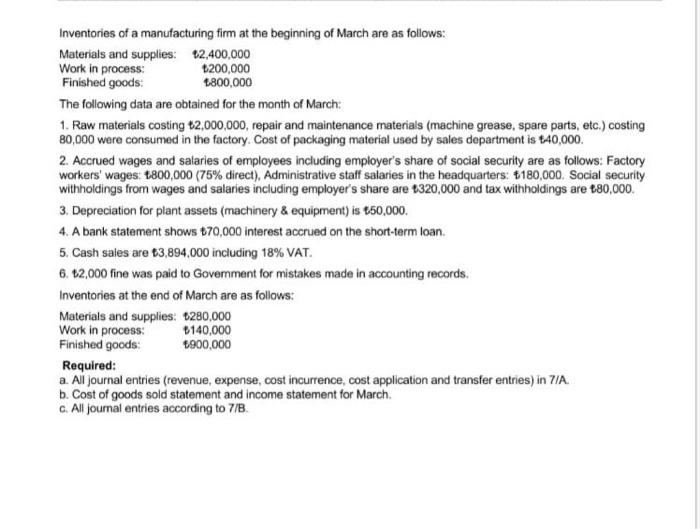

Inventories of a manufacturing firm at the beginning of March are as follows: Materials and supplies: 12,400,000 Work in process: 200,000 Finished goods 1800,000 The following data are obtained for the month of March: 1. Raw materials costing t2,000,000, repair and maintenance materials (machine grease, spare parts, etc.) costing 80,000 were consumed in the factory. Cost of packaging material used by sales department is 40,000 2. Accrued wages and salaries of employees including employer's share of social security are as follows: Factory workers' wages: 1.800,000 (75% direct), Administrative staff salaries in the headquarters: 6180,000. Social security withholdings from wages and salaries including employer's share are 1320,000 and tax withholdings are 180,000. 3. Depreciation for plant assets (machinery & equipment) is 50,000. 4. A bank statement shows +70,000 interest accrued on the short-term loan 5. Cash sales are 3,894,000 including 18% VAT 6. 12,000 fine was paid to Government for mistakes made in accounting records. Inventories at the end of March are as follows: Materials and supplies: $280,000 Work in process: $140,000 Finished goods: 1900,000 Required: a. Al journal entries (revenue, expense, cost incurrence, cost application and transfer entries) in 7/A. b. Cost of goods sold statement and income statement for March C. All journal entries according to 7/8 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started