Answered step by step

Verified Expert Solution

Question

1 Approved Answer

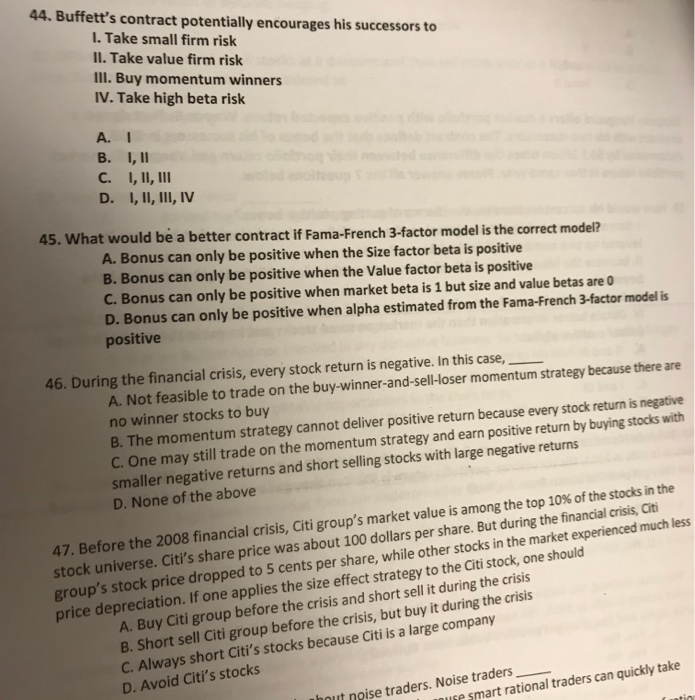

you can ignore 45 and do the rest also ignore 47 44. Buffett's contract potentially encourages his successors to I. Take small firm risk Il.

you can ignore 45 and do the rest

also ignore 47

44. Buffett's contract potentially encourages his successors to I. Take small firm risk Il. Take value firm risk III. Buy momentum winners IV. Take high beta risk A. I 45. W hat would be a better contract if Fama-French 3-factor model is the correct model? A. Bonus can only be positive when the Size factor beta is positive B. Bonus can only be positive when the Value factor beta is positive C. Bonus can only be positive when market beta is 1 but size and value betas are 0 D. Bonus can only be positive when alpha estimated from the Fama-French 3-factor model is positive 46. During the financial crisis, every stock return is negative. In this case, A. Not feasible to trade on the buy-winner-and-sell-loser momentum strategy because there are no winner stocks to buy B. The momentum strategy cannot deliver positive return because every stock return is negative C. One may still trade on the momentum strategy and earn positive return by buying stocks with smaller negative returns and short selling stocks with large negative returns D. None of the above stock universe. Citi's share price was about 100 dollars per share. But during the financial crisis Citi stock price dropped to 5 cents per share, while other stocks in the market experienced much less 47. Before the 2008 financial crisis, Citigroup's market value is among the top 10% of the stocks in the group's depreciation. If one applies the size effect strategy to the Citi stock, one should A. Buy Citi group before the crisis and short sell it during the crisis 8. Short sell Citi group before the crisis, but buy it during the crisis C. Always short Citi's stocks because Citi is a large company price D. Avoid Citi's stocks t ngise traders. Noise traders e smart rational traders can quickly take 44. Buffett's contract potentially encourages his successors to I. Take small firm risk Il. Take value firm risk III. Buy momentum winners IV. Take high beta risk A. I 45. W hat would be a better contract if Fama-French 3-factor model is the correct model? A. Bonus can only be positive when the Size factor beta is positive B. Bonus can only be positive when the Value factor beta is positive C. Bonus can only be positive when market beta is 1 but size and value betas are 0 D. Bonus can only be positive when alpha estimated from the Fama-French 3-factor model is positive 46. During the financial crisis, every stock return is negative. In this case, A. Not feasible to trade on the buy-winner-and-sell-loser momentum strategy because there are no winner stocks to buy B. The momentum strategy cannot deliver positive return because every stock return is negative C. One may still trade on the momentum strategy and earn positive return by buying stocks with smaller negative returns and short selling stocks with large negative returns D. None of the above stock universe. Citi's share price was about 100 dollars per share. But during the financial crisis Citi stock price dropped to 5 cents per share, while other stocks in the market experienced much less 47. Before the 2008 financial crisis, Citigroup's market value is among the top 10% of the stocks in the group's depreciation. If one applies the size effect strategy to the Citi stock, one should A. Buy Citi group before the crisis and short sell it during the crisis 8. Short sell Citi group before the crisis, but buy it during the crisis C. Always short Citi's stocks because Citi is a large company price D. Avoid Citi's stocks t ngise traders. Noise traders e smart rational traders can quickly take Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started