Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You can search on the internet. 42. A married couple with two children has $16,000 of earned income. What is the amount of their child

You can search on the internet.

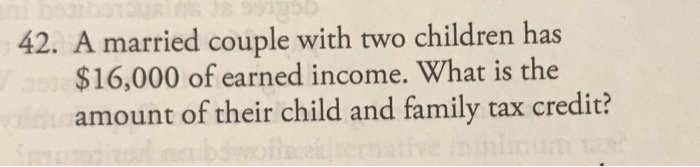

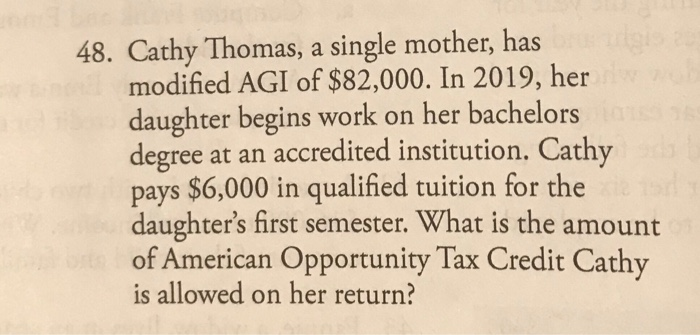

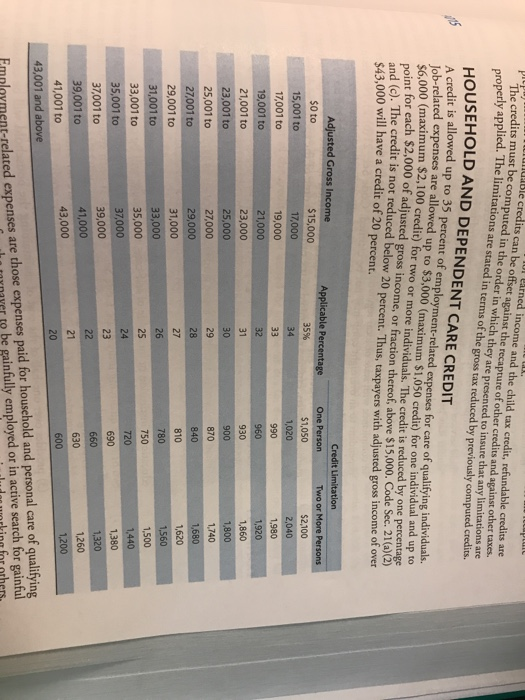

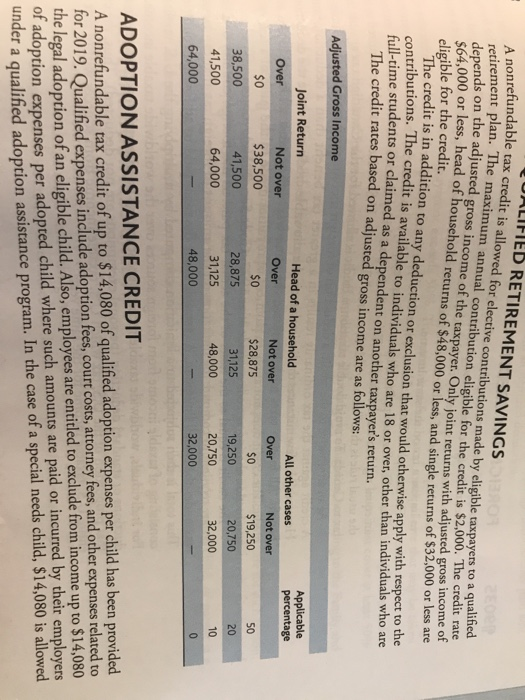

42. A married couple with two children has $16,000 of earned income. What is the amount of their child and family tax credit? 48. Cathy Thomas, a single mother, has modified AGI of $82,000. In 2019, her daughter begins work on her bachelors degree at an accredited institution. Cathy pays $6,000 in qualified tuition for the daughter's first semester. What is the amount of American Opportunity Tax Credit Cathy is allowed on her return? L earned income and the child tax credit, refundable credits are The credits must be computed in the order in which they are presented to insure that any limitations Dan be offset against the recapture of other credits and against other taxes. properly applied. The imitations are stated in terms of the gross tax reduced by previously computed credits operly applied. The limitations are The credits must be compulits can be offset againcome and the child tax HOUSEHOLD AND DEPENDENT CARE CREDIT Acredit is allowed up to 3 percent of employment-related expenses for care of qualifying individual Job-related expenses are allowed up to $3,000 (maximum $1.050 credit) for one individual and up to $6,000 (maximum $2,100 credit) for two or more individuals. The credit is reduced by one percentage point for each $2,000 of adjusted gross income, or fraction thereof, above $15.000. Code Sec. 21(a)(2) and (c). The credit is not reduced below 20 percent. Thus, taxpayers with adjusted gross income of over $43,000 will have a credit of 20 percent. Applicable Percentage 35% 990 930 Adjusted Gross Income $0 to $15,000 15,001 to 17,000 17,001 to 19,000 19,001 to 21,000 21,001 to 23,000 23,001 to 25,000 25,001 to 27,000 27,001 to 29,000 29,001 to 31,000 31,001 to 33,000 33,001 to 35,000 35,001 to 37,000 37,001 to 39,000 39,001 to 41,000 41,001 to 43,001 and above Credit Limitation One Person Two or More Persons $1,050 $2,100 1,020 2,040 1.980 960 1.920 1,860 900 1,800 1,740 840 1,680 810 1,620 1,560 1,500 1,440 1,380 1,320 1,260 1,200 780 660 43,000 630 600 Employment-related expenses are those expenses paid for household and personal care of qualifying lumenayer to be gainfully employed or in active search for gainful ludoworking for others. UALIFIED RETIREMENT SAVINGS nonrefundable tax credit is allowed for onrefundabid tax credit is allowed for elective contributions made by eligible taxpayers to retirement plan. The maximum annual contribution eligible for the credit is $2,000. The credit rate depends on the adjusted gross income of the taxpay e of the taxpayer. Only joint returns with adjusted gross income of $64,000 or less, head of household returns o usehold returns of $48,000 or less, and single returns of $32,000 or less are eligible for the credit. The credit is in addition to any deduction or exclusion that would otherwise apply with respect to the contributions. The credit is available to individuals who are 18 or over, other than individuals who are full-time students or claimed as a dependent on another taxpayer's return. The credit rates based on adjusted gross income are as follows: Adjusted Gross Income Applicable percentage Joint Return Over Not over $0 $38,500 38,500 41,500 41,500 64,000 64,000 Head of a household Not over $0 $28,875 28,875 31,125 31,125 48,000 48,000 All other cases Over Not over $0 $19,250 19,250 20,750 20,750 32,000 32,000 ADOPTION ASSISTANCE CREDIT A nonrefundable tax credit of up to $14,080 of qualified adoption expenses per child has been provided for 2019. Qualified expenses include adoption fees, court costs, attorney fees, and other expenses related to the legal adoption of an eligible child. Also, employees are entitled to exclude from income up to $14,080 of adoption expenses per adopted child where such amounts are paid or incurred by their employers under a qualified adoption assistance program. In the case of a special needs child, $14,080 is allowed Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started