Question

You cannot wait to graduate to start your career full-time at your dream company A, which is classified as a large-cap. Company A offers 401(K)

You cannot wait to graduate to start your career full-time at your dream company “A,” which is classified as a large-cap. Company A offers 401(K) with the following equity choices:

- stock “A”

- the ChicagoTrade S&P 500 Index Fund

- the ChicagoTrade Small-Cap Stock Fund (actively managed)

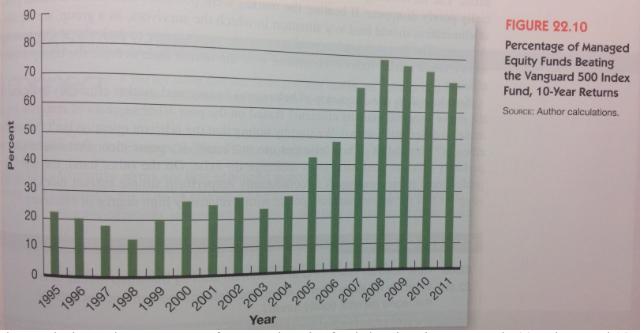

You also learned that returns from the ChicagoTrade S&P 500 Index Fund are similar to those from Vanguard S&P 500 Index Fund. The graph below shows the historical percentages of actively managed funds beating the Vanguard S&P 500.

The graph shows the percentage of managed equity funds beating the Vanguard 500 Index Fund 10-year returns.

Based on the graph, which of the following is correct?

In year 1993, there were about 80% of actively managed funds that performed better than the overall market. | ||||||||||||||||||||||||||

From 1986 to 2006, there are only two years (1986 and 1987) that Vanguard S&P 500 did better than 50% of actively managed funds. | ||||||||||||||||||||||||||

Market is efficient. | ||||||||||||||||||||||||||

All of the above (A, B, C) are correct. If you want to pick a vehicle for large-cap investment, all the information provided above means that your best choice for your 401(K) at company “A” is:

|

Percent 80 70 60 50 40 30 20 10 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 FIGURE 22.10 Percentage of Managed Equity Funds Beating the Vanguard 500 Index Fund, 10-Year Returns Sounce: Author calculations.

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Konswer 8 Marked is 1 Answer Reason efficient Market significant grows year dry year T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started