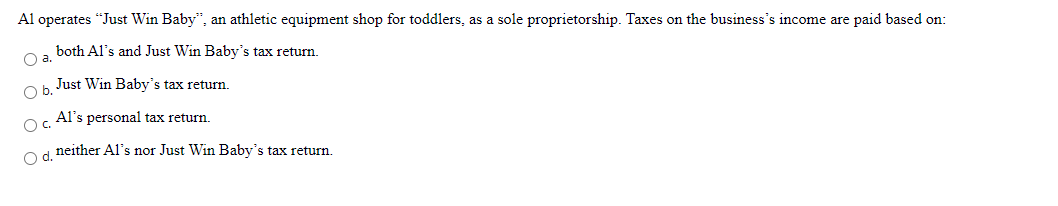

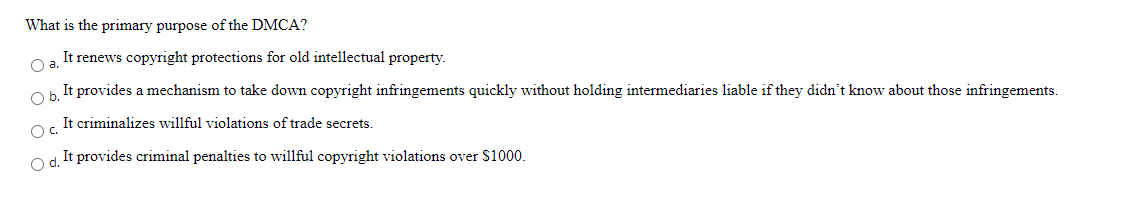

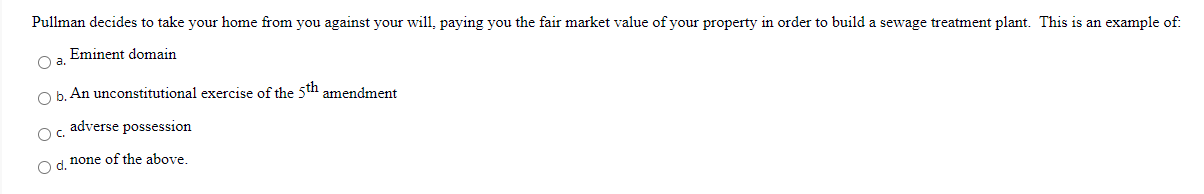

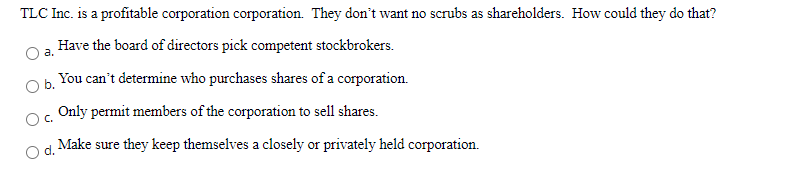

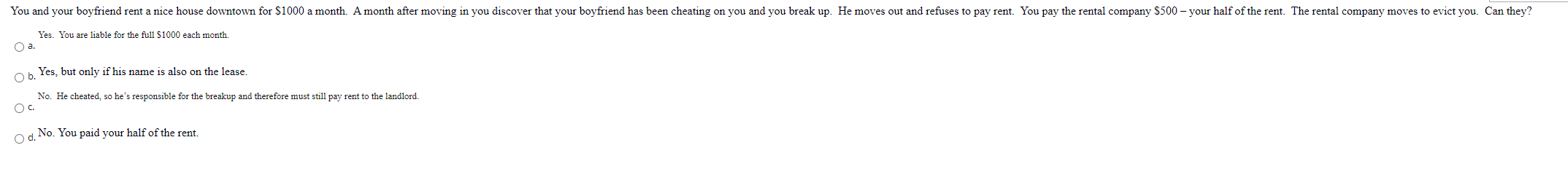

You come up with a new type of pancake. It's tasty, fluffy, gluten-free, fair trade, vegan and carnivore diet friendly at the same time, doesn't test on animals, and when you buy one they donate 2 pancakes, 1 to a homeless person and the other to a homeless dog, but not that homeless guy's dog. It's a different homeless guy's dog. They can share. You decide to protect the recipe with trade secret protection. How long does your trade secret protection last? O a. 10 years, but you can renew every 5 Ob. 14 years Oc 70 years after your death. Od, Forever Al operates "Just Win Baby, an athletic equipment shop for toddlers, as a sole proprietorship. Taxes on the business's income are paid based on: both Al's and Just Win Baby's tax return. O a. Just Win Baby's tax return. Ob. Al's personal tax return. . od neither Al's nor Just Win Baby's tax return. What is the primary purpose of the DMCA? O a. It renews copyright protections for old intellectual property. Ob. It provides a mechanism to take down copyright infringements quickly without holding intermediaries liable if they didn't know about those infringements. Oc. It criminalizes willful violations of trade secrets. Od. It provides criminal penalties to willful copyright violations over $1000. Pullman decides to take your home from you against your will, paying you the fair market value of your property in order to build a sewage treatment plant. This is an example of: O a. Eminent domain O b. An unconstitutional exercise of the 5th amendment adverse possession . od none of the above. A corporation whose shares are not publicly traded is a limited liability company. True False a. TLC Inc. is a profitable corporation corporation. They don't want no scrubs as shareholders. How could they do that? Have the board of directors pick competent stockbrokers. You can't determine who purchases shares of a corporation. Only permit members of the corporation to sell shares. Make sure they keep themselves a closely or privately held corporation. C. d. You and your boyfriend rent a nice house downtown for $1000 a month. A month after moving in you discover that your boyfriend has been cheating on you and you break up. He moves out and refuses to pay rent. You pay the rental company $500 - your half of the rent. The rental company moves to evict you. Can they? Yes. You are liable for the full $1000 each month. O a. Yes, but only if his name is also on the lease. Ob. No. He cheated, so he's responsible for the breakup and therefore must still pay rent to the landlord. OC. O d. No. You paid your half of the rent. You come up with a new type of pancake. It's tasty, fluffy, gluten-free, fair trade, vegan and carnivore diet friendly at the same time, doesn't test on animals, and when you buy one they donate 2 pancakes, 1 to a homeless person and the other to a homeless dog, but not that homeless guy's dog. It's a different homeless guy's dog. They can share. You decide to protect the recipe with trade secret protection. How long does your trade secret protection last? O a. 10 years, but you can renew every 5 Ob. 14 years Oc 70 years after your death. Od, Forever Al operates "Just Win Baby, an athletic equipment shop for toddlers, as a sole proprietorship. Taxes on the business's income are paid based on: both Al's and Just Win Baby's tax return. O a. Just Win Baby's tax return. Ob. Al's personal tax return. . od neither Al's nor Just Win Baby's tax return. What is the primary purpose of the DMCA? O a. It renews copyright protections for old intellectual property. Ob. It provides a mechanism to take down copyright infringements quickly without holding intermediaries liable if they didn't know about those infringements. Oc. It criminalizes willful violations of trade secrets. Od. It provides criminal penalties to willful copyright violations over $1000. Pullman decides to take your home from you against your will, paying you the fair market value of your property in order to build a sewage treatment plant. This is an example of: O a. Eminent domain O b. An unconstitutional exercise of the 5th amendment adverse possession . od none of the above. A corporation whose shares are not publicly traded is a limited liability company. True False a. TLC Inc. is a profitable corporation corporation. They don't want no scrubs as shareholders. How could they do that? Have the board of directors pick competent stockbrokers. You can't determine who purchases shares of a corporation. Only permit members of the corporation to sell shares. Make sure they keep themselves a closely or privately held corporation. C. d. You and your boyfriend rent a nice house downtown for $1000 a month. A month after moving in you discover that your boyfriend has been cheating on you and you break up. He moves out and refuses to pay rent. You pay the rental company $500 - your half of the rent. The rental company moves to evict you. Can they? Yes. You are liable for the full $1000 each month. O a. Yes, but only if his name is also on the lease. Ob. No. He cheated, so he's responsible for the breakup and therefore must still pay rent to the landlord. OC. O d. No. You paid your half of the rent