Answered step by step

Verified Expert Solution

Question

1 Approved Answer

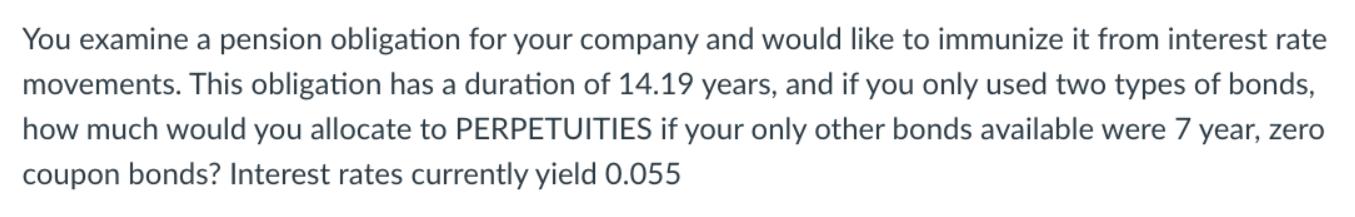

You examine a pension obligation for your company and would like to immunize it from interest rate movements. This obligation has a duration of

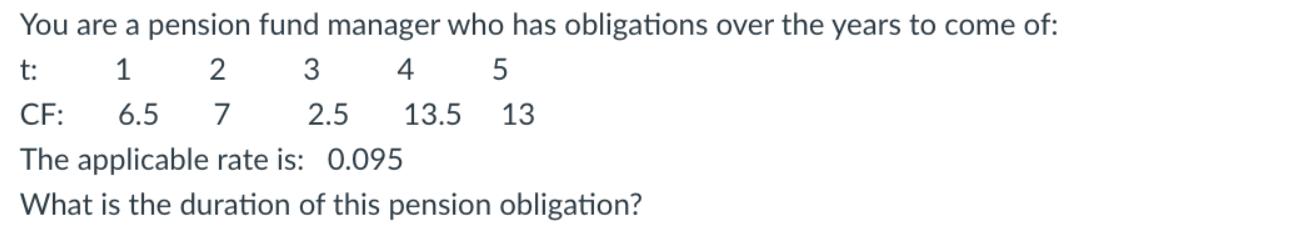

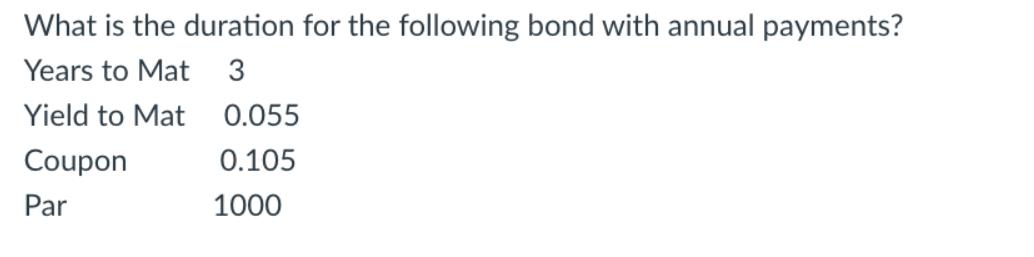

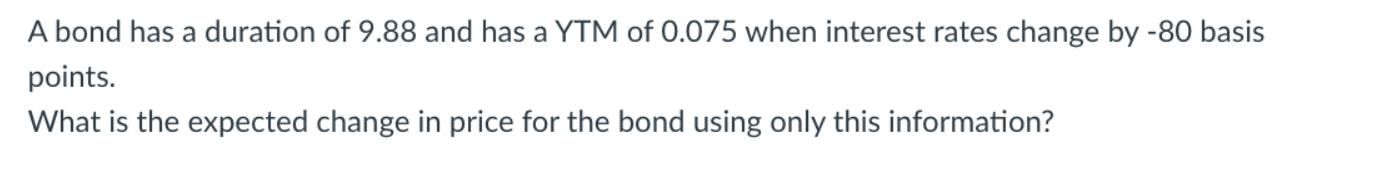

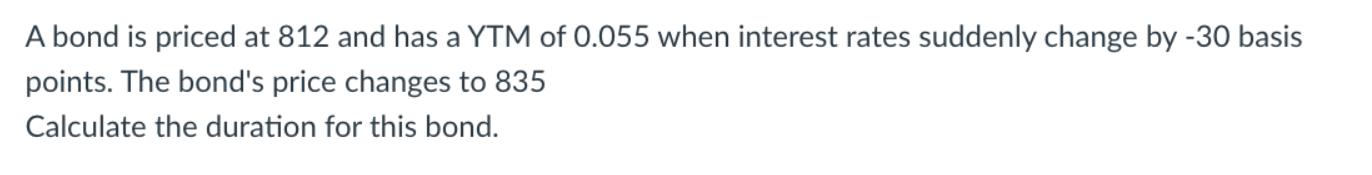

You examine a pension obligation for your company and would like to immunize it from interest rate movements. This obligation has a duration of 14.19 years, and if you only used two types of bonds, how much would you allocate to PERPETUITIES if your only other bonds available were 7 year, zero coupon bonds? Interest rates currently yield 0.055 You are a pension fund manager who has obligations over the years to come of: t: 1 2 3 4 5 CF: 6.5 7 2.5 13.5 13 The applicable rate is: 0.095 What is the duration of this pension obligation? What is the duration for the following bond with annual payments? Years to Mat 3 Yield to Mat Coupon Par 0.055 0.105 1000 A bond has a duration of 9.88 and has a YTM of 0.075 when interest rates change by -80 basis points. What is the expected change in price for the bond using only this information? A bond is priced at 812 and has a YTM of 0.055 when interest rates suddenly change by -30 basis points. The bond's price changes to 835 Calculate the duration for this bond.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the duration of the pension obligation t 1 2 3 4 5 6 7 CF 65 7 25 135 13 Duration t CF ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started