Answered step by step

Verified Expert Solution

Question

1 Approved Answer

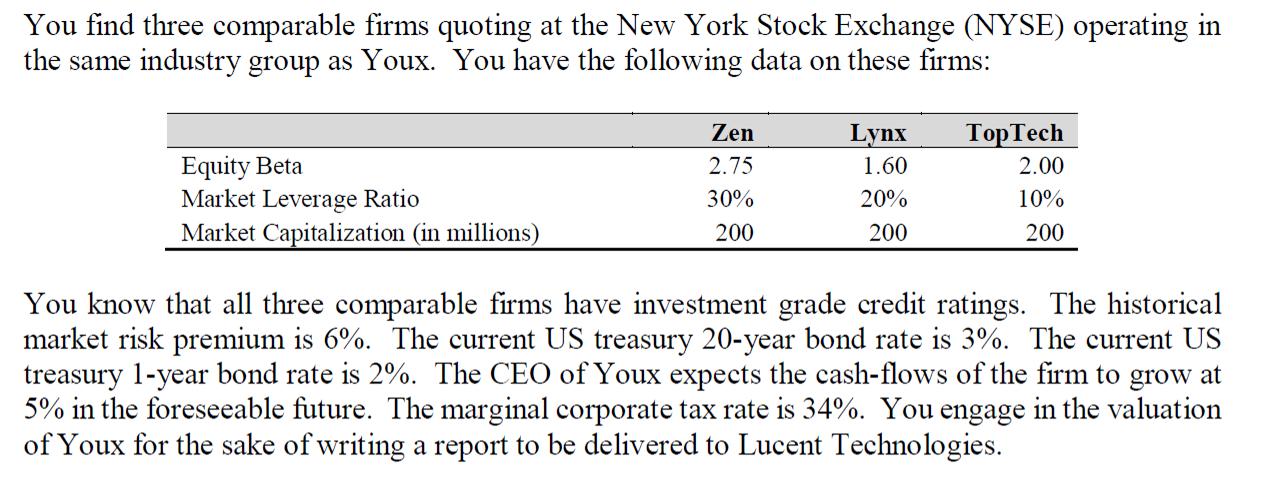

You find three comparable firms quoting at the New York Stock Exchange (NYSE) operating in the same industry group as Youx. You have the

You find three comparable firms quoting at the New York Stock Exchange (NYSE) operating in the same industry group as Youx. You have the following data on these firms: Equity Beta Market Leverage Ratio Market Capitalization (in millions) Zen Lynx TopTech 2.75 1.60 2.00 30% 20% 10% 200 200 200 You know that all three comparable firms have investment grade credit ratings. The historical market risk premium is 6%. The current US treasury 20-year bond rate is 3%. The current US treasury 1-year bond rate is 2%. The CEO of Youx expects the cash-flows of the firm to grow at 5% in the foreseeable future. The marginal corporate tax rate is 34%. You engage in the valuation of Youx for the sake of writing a report to be delivered to Lucent Technologies. Total grade: 100 points You are hired by Goldman Sharks (GS), a leading investment bank in the financial sector. Lucent Technologies is considering the purchase of Youx, a private firm in the electronics industry. Lucent has hired GS to evaluate the costs and benefits of the acquisition. As a preliminary step, your boss asks you to assess the value of Youx's assets as of year 2021. The current financial statements of Youx show that the firm is currently unlevered. The pro-forma statements of Youx for the incoming years contain the following information: The revenues of Youx are expected to be USD 80 million in 2022. The operating cost of Youx is expected to be 15% of its revenues in 2022. The operating margin of Youx will remain the same in the foreseeable future. Selling and general administrative expenses are expected to be 3% of Youx's revenues in 2022. These costs are expected to remain the same in the foreseeable future. The capital expenditures of Youx are expected to be 25% of its revenues. Youx will reinvest the same fraction of its revenues as capital expenditures in the subsequent years. The depreciation amounts to 30% of capital expenditures every period. Youx will spend USD 0.5 million in Research and Development (R&D) in 2022. R&D expenses are expected to grow proportionately to sales. Youx has no net working capital (i.e. current assets minus current liabilities) in 2021. Going forward, Youx will require a net working capital of 2% of revenues to operate. 2. Estimate the appropriate discount rate for Youx if Youx remains unlevered in the future. Carefully explain each step of your analysis. [20 points]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started