Answered step by step

Verified Expert Solution

Question

1 Approved Answer

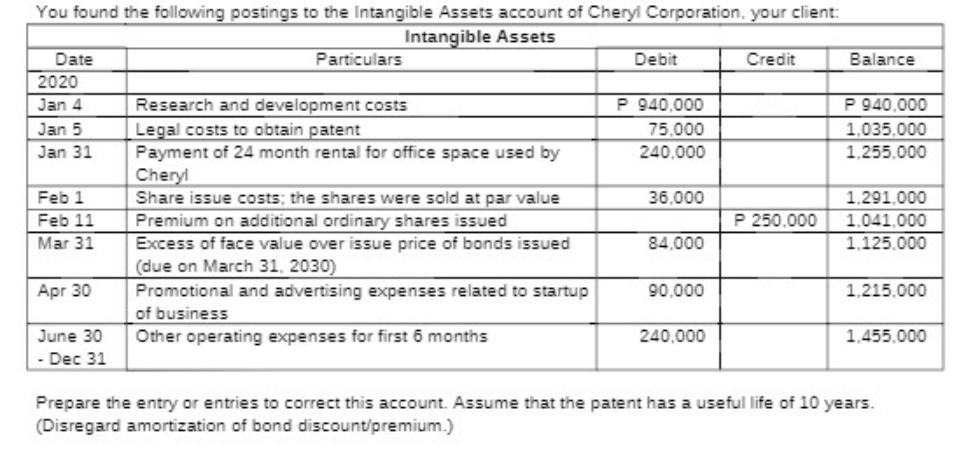

You found the following postings to the Intangible Assets account of Cheryl Corporation, your client: Intangible Assets Credit Date 2020 Jan 4 Jan 5

You found the following postings to the Intangible Assets account of Cheryl Corporation, your client: Intangible Assets Credit Date 2020 Jan 4 Jan 5 Jan 31 Feb 1 Feb 11 Mar 31 Apr 30 June 30 - Dec 31 Particulars Research and development costs Legal costs to obtain patent Payment of 24 month rental for office space used by Cheryl Share issue costs; the shares were sold at par value Premium on additional ordinary shares issued Excess of face value over issue price of bonds issued (due on March 31, 2030) Promotional and advertising expenses related to startup of business Other operating expenses for first 6 months Debit P 940,000 75.000 240,000 36,000 84,000 90,000 240,000 P 250,000 Balance P 940,000 1,035.000 1.255.000 1,291,000 1,041,000 1.125.000 1.215.000 1,455,000 Prepare the entry or entries to correct this account. Assume that the patent has a useful life of 10 years. (Disregard amortization of bond discount/premium.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To correct the Intangible Assets account we need to identify the proper treatment of each transaction and make the necessary adjustments Lets go throu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started