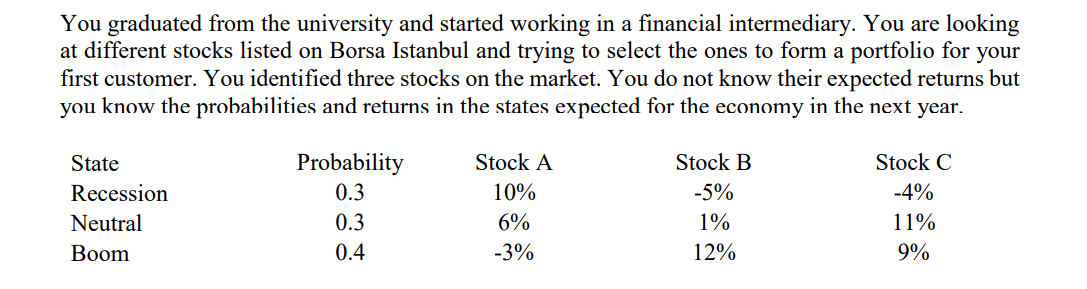

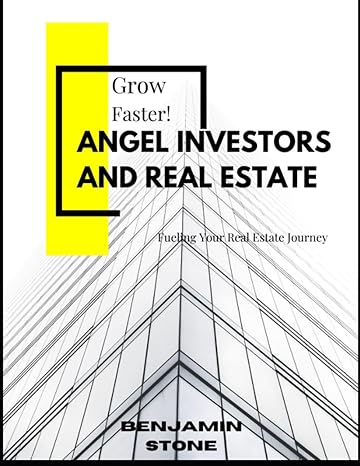

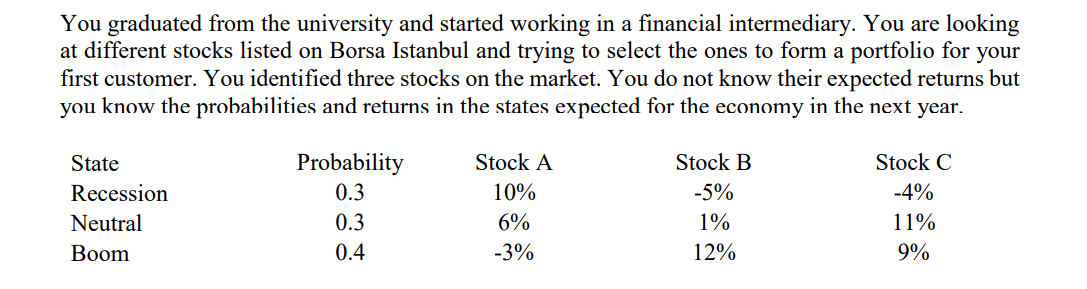

You graduated from the university and started working in a financial intermediary. You are looking at different stocks listed on Borsa Istanbul and trying to select the ones to form a portfolio for your first customer. You identified three stocks on the market. You do not know their expected returns but you know the probabilities and returns in the states expected for the economy in the next year. State Probability Stock C Stock B -5% Recession 0.3 -4% Stock A 10% 6% -3% Neutral 1% 11% 0.3 0.4 Boom 12% 9% 3. (6 points) Given the average returns and the standard deviations you have calculated for Stocks A, B and C, briefly discuss if you observe the risk-return trade off in this market. Briefly explain why or why not the observed results are an evidence for or against the risk-return trade off that should be available in financial markets. 4. (16 points) Suppose your client wants you to create a two stock portfolio with the maximum diversification benefit available in the market. Given the characteristics of these three securities, determine the two stocks you should put in your client's portfolio to achieve this and briefly explain why. You graduated from the university and started working in a financial intermediary. You are looking at different stocks listed on Borsa Istanbul and trying to select the ones to form a portfolio for your first customer. You identified three stocks on the market. You do not know their expected returns but you know the probabilities and returns in the states expected for the economy in the next year. State Probability Stock C Stock B -5% Recession 0.3 -4% Stock A 10% 6% -3% Neutral 1% 11% 0.3 0.4 Boom 12% 9% 3. (6 points) Given the average returns and the standard deviations you have calculated for Stocks A, B and C, briefly discuss if you observe the risk-return trade off in this market. Briefly explain why or why not the observed results are an evidence for or against the risk-return trade off that should be available in financial markets. 4. (16 points) Suppose your client wants you to create a two stock portfolio with the maximum diversification benefit available in the market. Given the characteristics of these three securities, determine the two stocks you should put in your client's portfolio to achieve this and briefly explain why