Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have $4,000. The current interest rates on dollar- and pound-denominated deposits for 180-day maturity are i $ =0.02 and i=0.03, respectively. The current spot

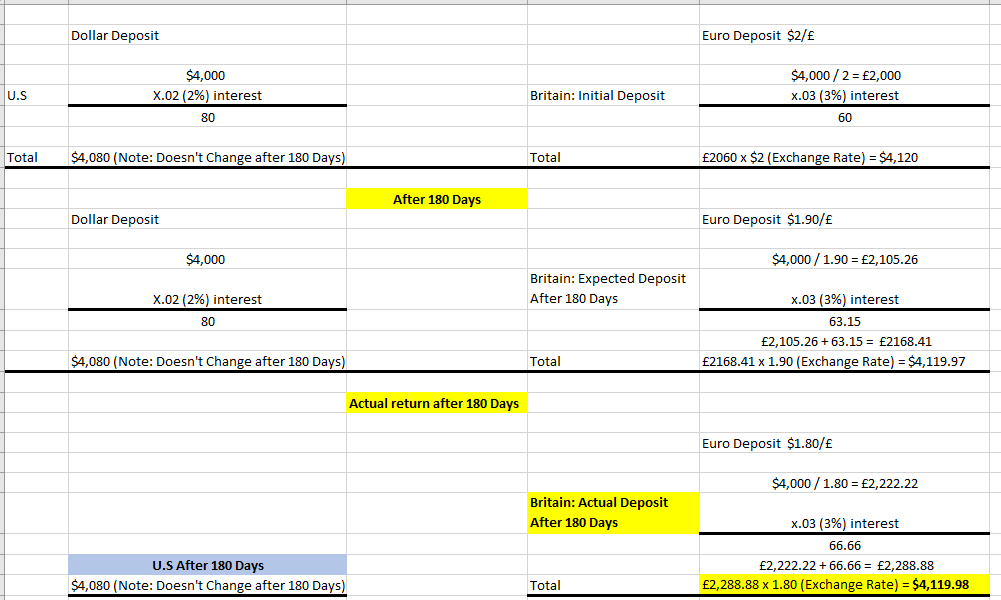

You have $4,000. The current interest rates on dollar- and pound-denominated deposits for 180-day maturity are i$=0.02 and i=0.03, respectively. The current spot exchange rate is e=$2/. Assume that you don't mind bearing foreign exchange risk. You expect the spot rate in 180 days to be $1.90/. What strategy would you follow, and why? After 180 days, the actual spot rate turns out to be $1.80/. Are you pleased with your decision? Why or why not?

U.S Total Dollar Deposit $4,000 X.02 (2%) interest 80 $4,080 (Note: Doesn't Change after 180 Days) Dollar Deposit $4,000 X.02 (2%) interest 80 After 180 Days $4,080 (Note: Doesn't Change after 180 Days) Actual return after 180 Days U.S After 180 Days Britain: Initial Deposit Total Britain: Expected Deposit After 180 Days Total Britain: Actual Deposit After 180 Days $4,080 (Note: Doesn't Change after 180 Days) Total Euro Deposit $2/ $4,000/2 2,000 x.03 (3%) interest 60 2060 x $2 (Exchange Rate) = $4,120 Euro Deposit $1.90/ $4,000/1.90 = 2,105.26 x.03 (3%) interest 63.15 2,105.26+ 63.15 = 2168.41 2168.41 x 1.90 (Exchange Rate) = $4,119.97 Euro Deposit $1.80/ $4,000/ 1.80 = 2,222.22 x.03 (3%) interest 66.66 2,222.22 + 66.66 = 2,288.88 2,288.88 x 1.80 (Exchange Rate) = $4,119.98

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The best strategy would be to convert the 4000 to pounds and deposit it in a pounddenominated accoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started