Answered step by step

Verified Expert Solution

Question

1 Approved Answer

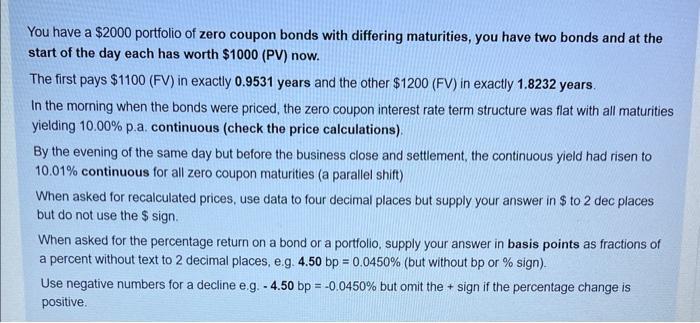

You have a $2000 portfolio of zero coupon bonds with differing maturities, you have two bonds and at the start of the day each

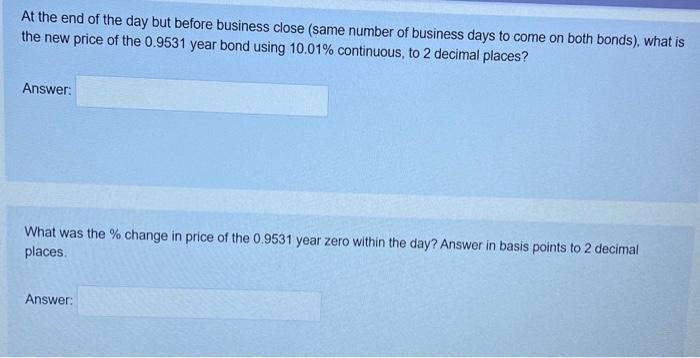

You have a $2000 portfolio of zero coupon bonds with differing maturities, you have two bonds and at the start of the day each has worth $1000 (PV) now. The first pays $1100 (FV) in exactly 0.9531 years and the other $1200 (FV) in exactly 1.8232 years. In the morning when the bonds were priced, the zero coupon interest rate term structure was flat with all maturities yielding 10.00% p.a. continuous (check the price calculations). By the evening of the same day but before the business close and settlement, the continuous yield had risen to 10.01% continuous for all zero coupon maturities (a parallel shift) When asked for recalculated prices, use data to four decimal places but supply your answer in $ to 2 dec places but do not use the $ sign. When asked for the percentage return on a bond or a portfolio, supply your answer in basis points as fractions of a percent without text to 2 decimal places, e.g. 4.50 bp = 0.0450% (but without bp or % sign). Use negative numbers for a decline e.g. - 4.50 bp = -0.0450 % but omit the + sign if the percentage change is positive. At the end of the day but before business close (same number of business days to come on both bonds), what is the new price of the 0.9531 year bond using 10.01% continuous, to 2 decimal places? Answer: What was the % change in price of the 0.9531 year zero within the day? Answer in basis points to 2 decimal places. Answer:

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the new price of the 09531year bond using the continuous yield of 1001 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started