Answered step by step

Verified Expert Solution

Question

1 Approved Answer

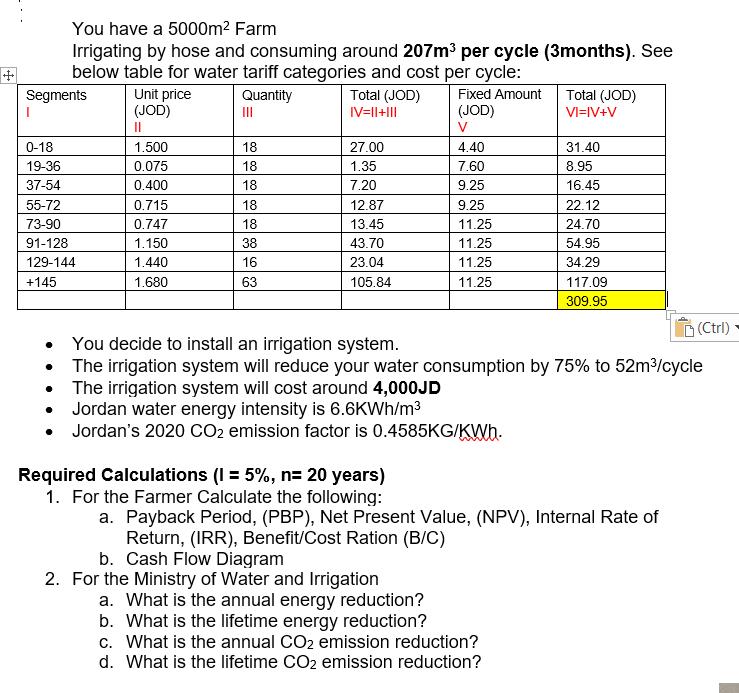

You have a 5000m Farm Irrigating by hose and consuming around 207m per cycle (3months). See below table for water tariff categories and cost

You have a 5000m Farm Irrigating by hose and consuming around 207m per cycle (3months). See below table for water tariff categories and cost per cycle: Segments Quantity ||| 0-18 19-36 37-54 55-72 73-90 91-128 129-144 +145 Unit price (JOD) || 1.500 0.075 0.400 0.715 0.747 1.150 1.440 1.680 18 18 18 18 18 38 16 63 Total (JOD) IV=||+||| 27.00 1.35 7.20 12.87 13.45 43.70 23.04 105.84 Fixed Amount (JOD) V 4.40 7.60 9.25 9.25 11.25 11.25 11.25 11.25 Jordan water energy intensity is 6.6KWh/m Jordan's 2020 CO2 emission factor is 0.4585KG/KWb. b. Cash Flow Diagram 2. For the Ministry of Water and Irrigation Total (JOD) VI=IV+V 31.40 8.95 16.45 22.12 24.70 54.95 34.29 You decide to install an irrigation system. The irrigation system will reduce your water consumption by 75% to 52m/cycle The irrigation system will cost around 4,000JD a. What is the annual energy reduction? b. What is the lifetime energy reduction? C. What is the annual CO emission reduction? d. What is the lifetime CO2 emission reduction? 117.09 309.95 Required Calculations (1= 5%, n= 20 years) 1. For the Farmer Calculate the following: a. Payback Period, (PBP), Net Present Value, (NPV), Internal Rate of Return, (IRR), Benefit/Cost Ration (B/C) (Ctrl)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the required calculations one by one based on the given question 1 For the Farmer Calculate the following Payback Period PBP Net Present Value NPV Internal Rate of Return IRR BenefitCo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started