Answered step by step

Verified Expert Solution

Question

1 Approved Answer

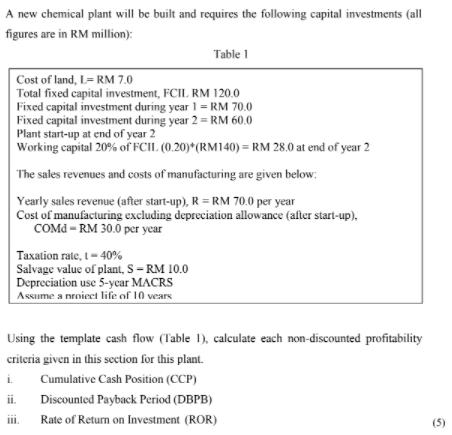

A new chemical plant will be built and requires the following capital investments (all figures are in RM million): Table 1 Cost of land,

A new chemical plant will be built and requires the following capital investments (all figures are in RM million): Table 1 Cost of land, L- RM 7.0 Total fixed capital investment, FCIL RM 120.0 Fixed capital investment during year 1 = RM 70.0 Fixed capital investment during year 2= RM 60.0 Plant start-up at end of year 2 Working capital 20% of FCIL (0.20)*(RM140) = RM 28.0 at end of year 2 The sales revenues and costs of manufacturing are given below: Yearly sales revenue (after start-up), R = RM 70.0 per year Cost of manufacturing excluding depreciation allowance (after start-up). COMA- RM 30.0 per year Taxation rate, 1 - 40% Salvage value of plant, S-RM 10.0 Depreciation use 5-year MACRS Assume a nroiect life of 10 years Using the template cash flow (Table 1), calculate each non-discounted profitability criteria given in this section for this plant. L Cumulative Cash Position (CCP) ii. Discounted Payback Period (DBPB) Rate of Return on Investment (ROR) (5)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

iCCP R COMd WCCOMd Depreciation 1T RCOMd CCP R COM...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started