Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have a potential project for which you want to establish the value of any possible real options. The project will have an initial

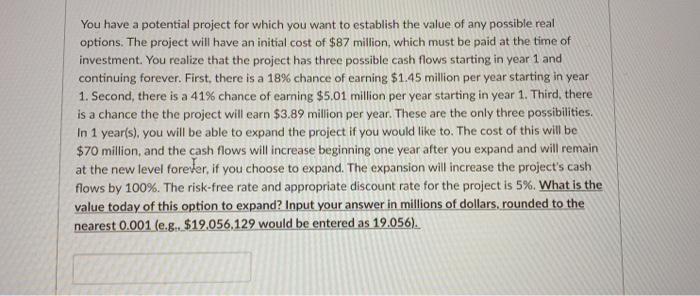

You have a potential project for which you want to establish the value of any possible real options. The project will have an initial cost of $87 million, which must be paid at the time of investment. You realize that the project has three possible cash flows starting in year 1 and continuing forever. First, there is a 18% chance of earning $1.45 million per year starting in year 1. Second, there is a 41% chance of earning $5.01 million per year starting in year 1. Third, there is a chance the the project will earn $3.89 million per year. These are the only three possibilities. In 1 year(s), you will be able to expand the project if you would like to. The cost of this will be $70 million, and the cash flows will increase beginning one year after you expand and will remain at the new level forever, if you choose to expand. The expansion will increase the project's cash flows by 100%. The risk-free rate and appropriate discount rate for the project is 5%. What is the value today of this option to expand? Input your answer in millions of dollars, rounded to the nearest 0.001 (e.g.. $19.056,129 would be entered as 19.056).

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Expected Cash Flow 018 x 145 041 x 501 041 x 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started