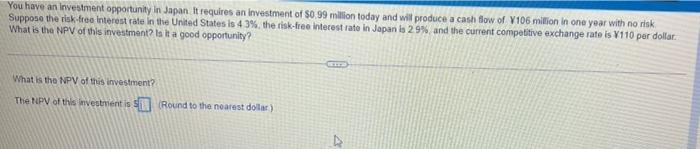

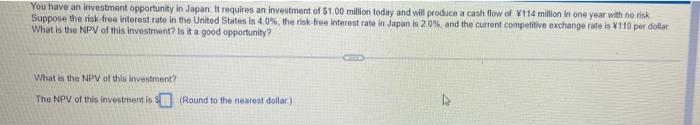

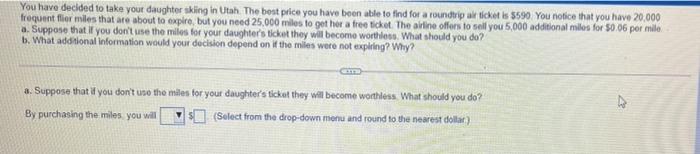

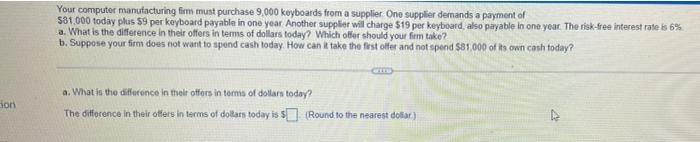

You have an investment opportunity in Japan. It requires an investment of $0.99 million today and will produce a cash flow of V106 million in one year with no risk Suppose the risk free interest rate in the United States is 4 3% the risk-free interest rate in Japan is 29% and the current competitive exchange rate is 1110 per dollar. What is the NPV of this investment? Is ta good opportunity? What is the NPV of this investment? The NPV of this wvestment is 51 Round to the nearest dollar) V You have an investment opportunity in Japan. It requires an investment of $1.00 million today and will produce a cash flow of W114 million in one year with no risk Suppose the risk-free interest rate in the United States is 40%, the risk free interest rate in Japan is 20% and the current competitive exchange rate is 110 per dollar What is the NPV of this investment? Is it a good opportunity? What is the NPV of this investment? The NPV of this Investment is $ (Round to the nearest dollar) You have decided to take your daughter skiing in Utah. The best price you have been able to find for aroundtrip ar ticket is 5590 You notice that you have 20.000 frequent for miles that are about to expire, but you need 25,000 miles to get her a free ticket. The airine offers to sell you 5,000 additional miles for $0.06 por milo a. Suppose that if you don't use the miles for your daughter's ticket they will become worthless. What should you do? b. What additional Information would your decision depend on if the miles were not expiring? Why? CE 3. Suppose that if you don't use the miles for your daughter's ticket they will become worthless What should you do? By purchasing the miles you will (Select from the drop-down menu and round to the nearest dollar) Your computer manufacturing firm must purchase 9,000 kwyboards from a supplier One supplier demands a payment of $31.000 today plus $9 per keyboard payable in one year Another supplier will charge 519 per keyboard, also payable in one year. The risk-free interest rate is 6%. a. What is the difference in their offers in terms of dollars today? Which offer should your firm tako? b. Suppose your firm does not want to spend cash today. How can take the first offer and not spend $81.000 of its own cash today? Jon a. What is the difference in their offers in terms of dollars today? The difference in their offers in terms of dollars today is $(Round to the nearest dolar)