Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been appointed manager of an operating division of The Bluth Company, a producer of frozen bananas. On January 1 of this year,

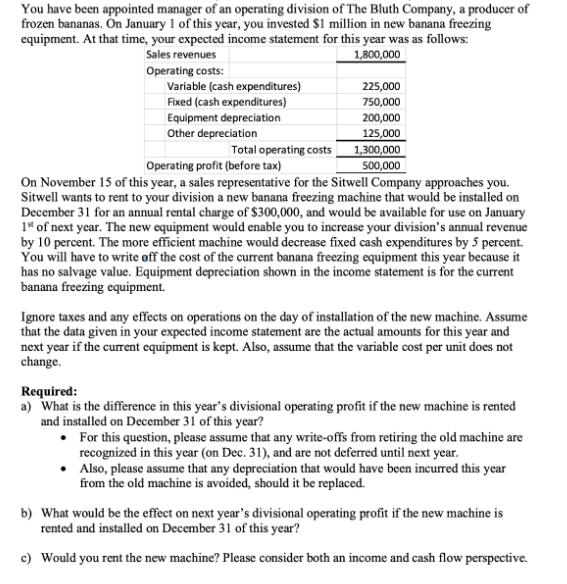

You have been appointed manager of an operating division of The Bluth Company, a producer of frozen bananas. On January 1 of this year, you invested $1 million in new banana freezing equipment. At that time, your expected income statement for this year was as follows: Sales revenues 1,800,000 Operating costs: Variable (cash expenditures) Fixed (cash expenditures) Equipment depreciation Other depreciation 225,000 750,000 200,000 125,000 Total operating costs 1,300,000 500,000 Operating profit (before tax) On November 15 of this year, a sales representative for the Sitwell Company approaches you. Sitwell wants to rent to your division a new banana freezing machine that would be installed on December 31 for an annual rental charge of $300,000, and would be available for use on January 1st of next year. The new equipment would enable you to increase your division's annual revenue by 10 percent. The more efficient machine would decrease fixed cash expenditures by 5 percent. You will have to write off the cost of the current banana freezing equipment this year because it has no salvage value. Equipment depreciation shown in the income statement is for the current banana freezing equipment. Ignore taxes and any effects on operations on the day of installation of the new machine. Assume that the data given in your expected income statement are the actual amounts for this year and next year if the current equipment is kept. Also, assume that the variable cost per unit does not change. Required: a) What is the difference in this year's divisional operating profit if the new machine is rented and installed on December 31 of this year? For this question, please assume that any write-offs from retiring the old machine are recognized in this year (on Dec. 31), and are not deferred until next year. Also, please assume that any depreciation that would have been incurred this year from the old machine is avoided, should it be replaced. b) What would be the effect on next year's divisional operating profit if the new machine is rented and installed on December 31 of this year? c) Would you rent the new machine? Please consider both an income and cash flow perspective.

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the difference in this years divisional operating profit if the new machine is rented and installed on December 31 of this year we need to compare the operating profit with and without th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started