Answered step by step

Verified Expert Solution

Question

1 Approved Answer

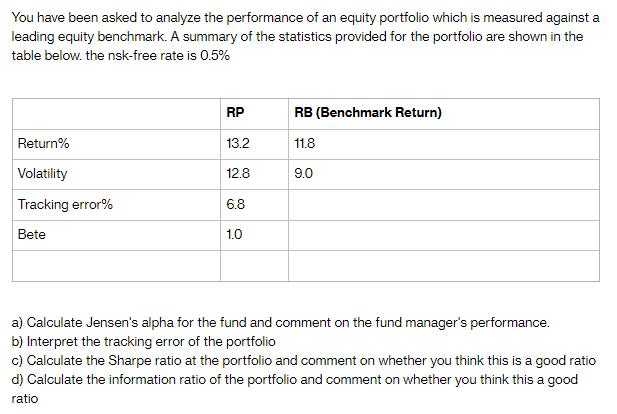

You have been asked to analyze the performance of an equity portfolio which is measured against a leading equity benchmark. A summary of the

You have been asked to analyze the performance of an equity portfolio which is measured against a leading equity benchmark. A summary of the statistics provided for the portfolio are shown in the table below. the nsk-free rate is 0.5% Return% Volatility Tracking error% Bete RP 13.2 12.8 6.8 1.0 RB (Benchmark Return) 11.8 9.0 a) Calculate Jensen's alpha for the fund and comment on the fund manager's performance. b) Interpret the tracking error of the portfolio c) Calculate the Sharpe ratio at the portfolio and comment on whether you think this is a good ratio d) Calculate the information ratio of the portfolio and comment on whether you think this a good ratio

Step by Step Solution

★★★★★

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions lets go through each one a Jensens alpha is a measure of the excess return of a portfolio over its expected return given its level of risk It is calculated using the formula J...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started