Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been asked to analyze the value of an oil company with substantial oil reserves. The estimated reserves amount to 11,000,000 barrels and

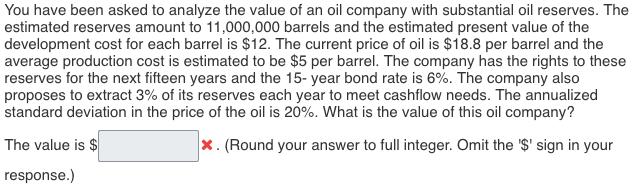

You have been asked to analyze the value of an oil company with substantial oil reserves. The estimated reserves amount to 11,000,000 barrels and the estimated present value of the development cost for each barrel is $12. The current price of oil is $18.8 per barrel and the average production cost is estimated to be $5 per barrel. The company has the rights to these reserves for the next fifteen years and the 15-year bond rate is 6%. The company also proposes to extract 3% of its reserves each year to meet cashflow needs. The annualized standard deviation in the price of the oil is 20%. What is the value of this oil company? The value is $ x. (Round your answer to full integer. Omit the '$' sign in your response.)

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer The value of the oil company can be calculated using the following formula Value 11000000 x 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started