Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been asked to write a financial analysis report for Companies Companies Y and Z . Company Y has a debt - to -

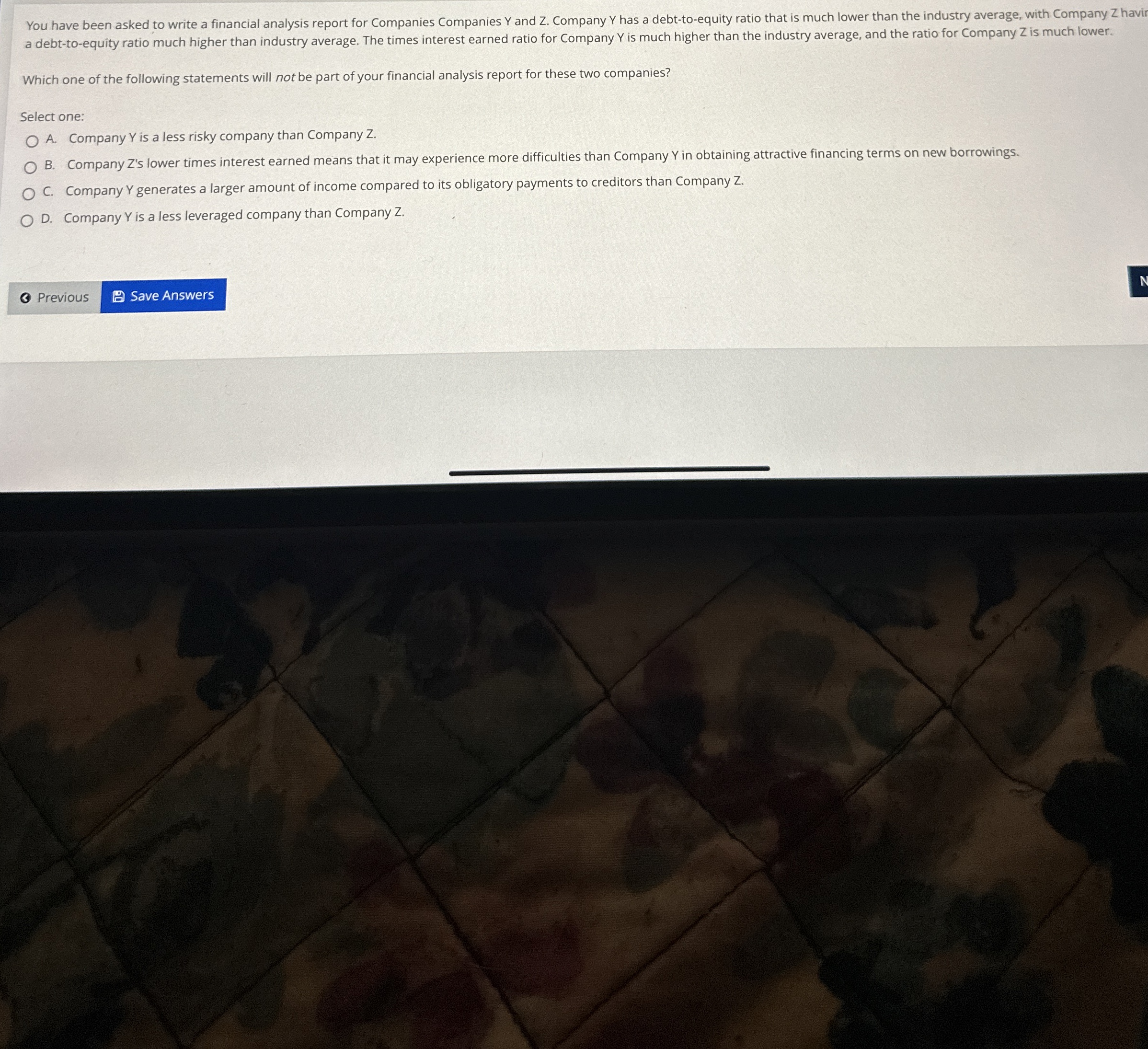

You have been asked to write a financial analysis report for Companies Companies and Company has a debttoequity ratio that is much lower than the industry average, with Company havir a debttoequity ratio much higher than industry average. The times interest earned ratio for Company is much higher than the industry average, and the ratio for Company is much lower.

Which one of the following statements will not be part of your financial analysis report for these two companies?

Select one:

A Company is a less risky company than Company

B Company Zs lower times interest earned means that it may experience more difficulties than Company Y in obtaining attractive financing terms on new borrowings.

C Company generates a larger amount of income compared to its obligatory payments to creditors than Company

D Company is a less leveraged company than Company

You have been asked to write a financial analysis report for Companies Companies and Company has a debttoequity ratio that is much lower than the industry average, with Company havir a debttoequity ratio much higher than industry average. The times interest earned ratio for Company is much higher than the industry average, and the ratio for Company is much lower.

Which one of the following statements will not be part of your financial analysis report for these two companies?

Select one:

A Company is a less risky company than Company

B Company Zs lower times interest earned means that it may experience more difficulties than Company Y in obtaining attractive financing terms on new borrowings.

C Company generates a larger amount of income compared to its obligatory payments to creditors than Company

D Company is a less leveraged company than Company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started