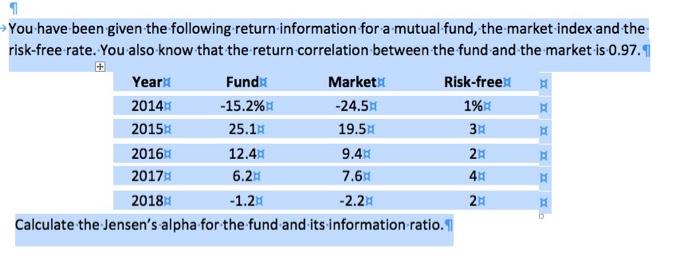

Question: - You have been given the following return information for a mutual fund, the market index and the risk-free rate. You also know that the

- You have been given the following return information for a mutual fund, the market index and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97.4 Years Funda Market Risk-free 2014 -15.2% -24.5H 1% 2015 25.10 19.5 2016 12.4 9.44 2 2017 6.2 7.6 4 2018 -1.24 -2.24 2 Calculate the Jensen's alpha for the fund and its information ratio. 1 3 - You have been given the following return information for a mutual fund, the market index and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97.4 Years Funda Market Risk-free 2014 -15.2% -24.5H 1% 2015 25.10 19.5 2016 12.4 9.44 2 2017 6.2 7.6 4 2018 -1.24 -2.24 2 Calculate the Jensen's alpha for the fund and its information ratio. 1 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts