Answered step by step

Verified Expert Solution

Question

1 Approved Answer

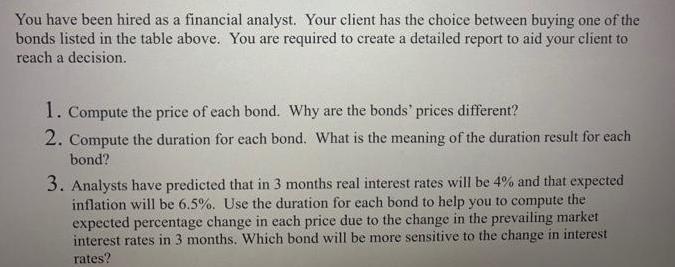

You have been hired as a financial analyst. Your client has the choice between buying one of the bonds listed in the table above.

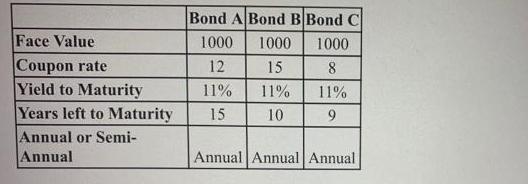

You have been hired as a financial analyst. Your client has the choice between buying one of the bonds listed in the table above. You are required to create a detailed report to aid your client to reach a decision. 1. Compute the price of each bond. Why are the bonds' prices different? 2. Compute the duration for each bond. What is the meaning of the duration result for each bond? 3. Analysts have predicted that in 3 months real interest rates will be 4% and that expected inflation will be 6.5%. Use the duration for each bond to help you to compute the expected percentage change in each price due to the change in the prevailing market interest rates in 3 months. Which bond will be more sensitive to the change in interest rates? Face Value Coupon rate Yield to Maturity Years left to Maturity Annual or Semi- Annual Bond A Bond B Bond C 1000 1000 1000 12 15 8 11% 11% 11% 15 10 9 Annual Annual Annual

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To aid your client in making a decision lets analyze the bonds based on the provided information 1 Computing the price of each bond The price of a bond can be calculated using the present value of its ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started