Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been hired as a management consultant by FDS Corporation in evaluate whether it has an appropriate amount of debt [the company is worried

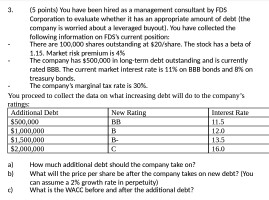

You have been hired as a management consultant by FDS Corporation in evaluate whether it has an appropriate amount of debt [the company is worried about a leveraged buy cut.] You have collected the following information on FDS's current position - There are 100, 000 shares outstanding at $20/share. The stock has a beta of 1.15, Market rise premium is 4% - The company has $500, 000 in long-term debt outstanding and is currently rated BBB. The current market interest rate is 11% on BBB bonds and B% on treasury bonds. - The company's marginal tax rate is 30%. You proceed to collect the data on what increasing debt will do to the company's ratings: a) How much additional debt should the company take on? b) What will the price per share be after the company takes on new debt? [You can assume a 2% growth rate in perpetuity) c) What is the WACC before and after the additional debt? You have been hired as a management consultant by FDS Corporation in evaluate whether it has an appropriate amount of debt [the company is worried about a leveraged buy cut.] You have collected the following information on FDS's current position - There are 100, 000 shares outstanding at $20/share. The stock has a beta of 1.15, Market rise premium is 4% - The company has $500, 000 in long-term debt outstanding and is currently rated BBB. The current market interest rate is 11% on BBB bonds and B% on treasury bonds. - The company's marginal tax rate is 30%. You proceed to collect the data on what increasing debt will do to the company's ratings: a) How much additional debt should the company take on? b) What will the price per share be after the company takes on new debt? [You can assume a 2% growth rate in perpetuity) c) What is the WACC before and after the additional debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started