Question

You have been hired by a company that manufactures writing instruments. Although revenues for the company have been increasing, the company has been showing declining

You have been hired by a company that manufactures writing instruments. Although revenues for the company have been increasing, the company has been showing declining profits over the past several years. The company is at a loss on what is causing the problem and several alternatives have been suggested to improve company profitability including expanding product lines (adding new products), cutting product lines, and reducing costs company-wide. The owner is confident that materials, direct labor, and fringe benefits on direct labor are correct however he questions the indirect costs. You are provided with the income statement below and asked to analyze the indirect cost allocation using activity-based costing.

Your first task was to interview Production. During this process you learned that the pen manufacturing process required four activities: (1) setting up production runs, (2) managing production runs, and (3) managing products. The fourth activity did not require labor; it was simply the operation of machinery. Next, you went to the accounting records to get a breakdown of indirect costs. Here is what you found:

Indirect labor $ 20,000

Fringe benefits on labor 8,000

Information technology 10,000

Machinery depreciation 8,000

Machinery maintenance 4,000

Energy 2,000

Total $ 52,000

Then, you began a series of interview with the department heads to see how to assign these costs to cost pools. You found that 40 percent of indirect labor was for scheduling or for handling production runs, including purchasing, preparing the production run, releasing materials for the production run, and performing a first-time inspection of the run. Another 50 percent of indirect labor was used to set upmachinery to produce a particular product. The remaining 10% of indirect labor was spent maintaining records for each of the four products, monitoring the supply of raw materials required for each product, and improving the production processes for each product. This 10% of indirect labor was assigned to the cost driver ?number of products.? Interviews with people in the Information Technology Department indicated that $10,000 was allocated to the pen production line. Eighty percent of this $10,000 information technology cost was for scheduling production runs. Twenty percent of the cost was for recordkeeping for each of the fourproducts.

Fringe benefits were 40 percent of labor costs. The rest of the overhead was used to supply machine capacity of 10,000 hours of productive time. You then found the following cost driver volumes from interviews with production personnel.

? Setups: 560 labor-hours for setups

? Production runs: 110 production runs

? Number of products: 4 products

? Machine-hour capacity: 10,000 hours

Blue pens used 200 setup hours, 40 production runs, and 5,000 machine-hours to produce 50,000 units. Black pens used 60 setup hours, 30 production runs, and 4,000 machine-hours to produce 40,000 units. Red glow pens used 240 setup hours, 30 production runs, and 900 machine-hours to produce 9,000 units. Purple glow pens used 60 setup hours, 10 production runs, and 100 machine-hours to produce 1,000 units. You learned that the production people had a difficult time with the glow pens, so these products required more setup than either the blue or black pens.

Required:

(4) Prepare a memorandum to the owner of the company, Mr. Scribner, recommending what to do. Be sure to include financial information in your memo to support your recommendation.

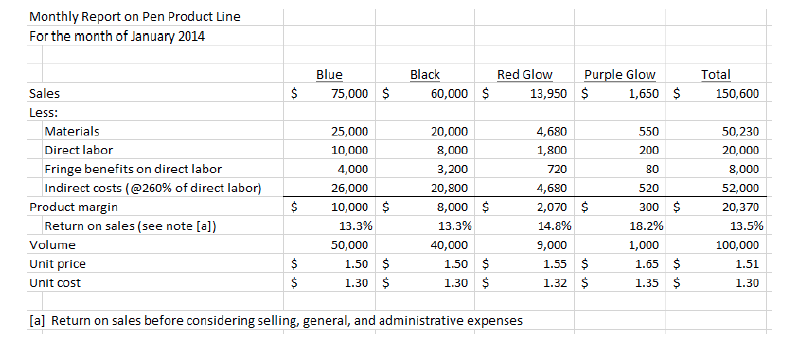

Monthly Report on Pen Product Line For the month of January 2014 Blue Black Red Glovw Purple Glow Total Sales $75,000 $ 60,000 $ 13,950 1,650 S150,600 Less: Material:s Direct labor Fringe benefits on direct labor Indirect costs (@260% of direct labor) 25,000 10,000 4,000 26,000 20,000 8,000 3,200 20,800 4,680 1,800 720 4,680 550 200 80 520 50,230 20,000 8,000 52,000 20,370 Product margin $10,000 $ 8,000 $ 2,070 $ 300 $ 13.5% 100,000 1.51 1.30 13.3% 14.8% 9,000 Return on sales (see note [a]) 13.3% 18.2% Volume Unit price Unit cost 50,000 40,000 1,000 1.50 $ 1.30$ 1.50 $ 1.30 $ 1.55 $ 1.32 $ 1.65 $ 1.35 $ [a] Return on sales before considering selling, general, and administrative expensesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started