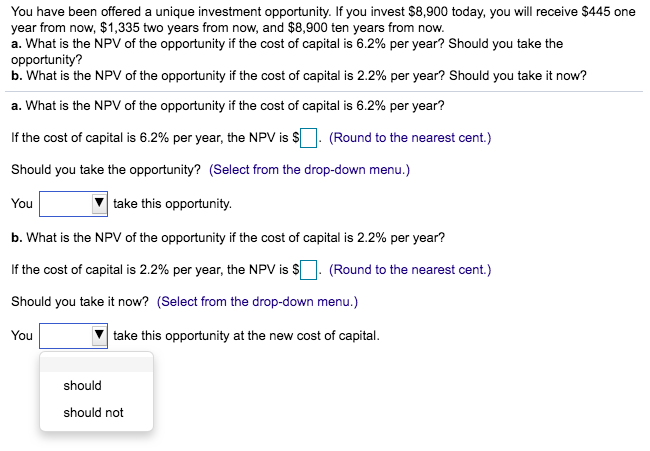

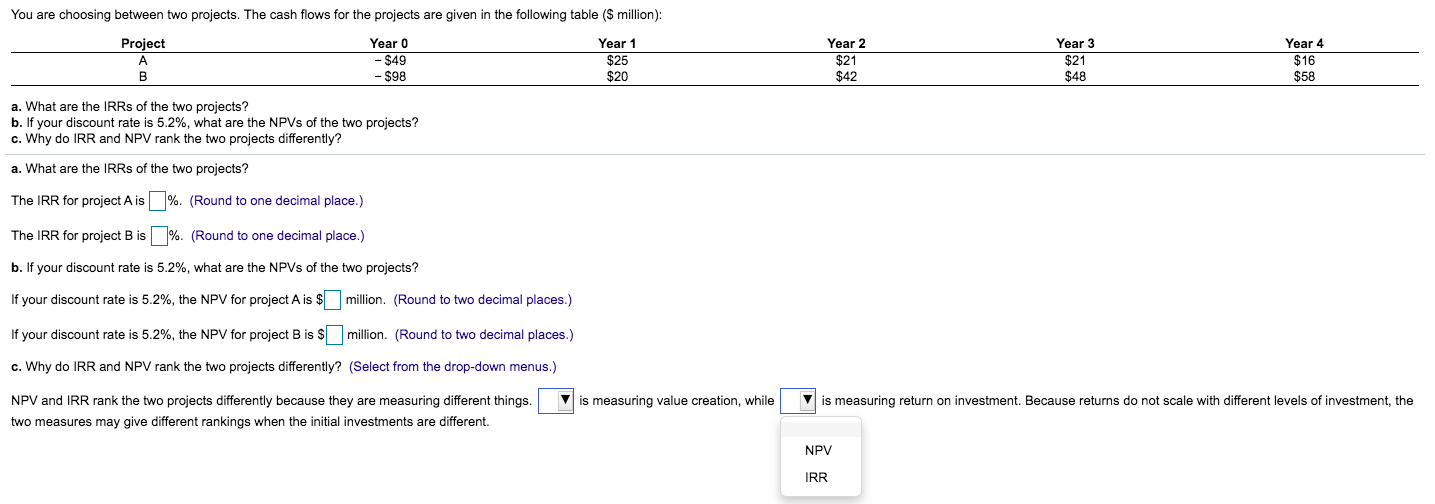

You have been offered a unique investment opportunity. If you invest $8,900 today, you will receive $445 one year from now, $1,335 two years from now. and $8.900 ten vears from now. a. What is the NPV of the opportunity if the cost of capital is 6.2% per year? Should you take the opportunity? b. What is the NPV of the opportunity if the cost of capital is 2.2% per year? Should you take it now? a. What is the NPV of the opportunity if the cost of capital is 6.2% per year? If the cost of capital is 6.2% per year, the NPV is $ . (Round to the nearest cent.) Should you take the opportunity? (Select from the drop-down menu.) You take this opportunity. b. What is the NPV of the opportunity if the cost of capital is 2.2% per year? If the cost of capital is 2.2% per year, the NPV is $ . (Round to the nearest cent.) Should you take it now? (Select from the drop-down menu.) You take this opportunity at the new cost of capital. should should not You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): Project Year 0 - $49 - $98 Year 1 $25 $20 Year 2 $21 $42 Year 3 $21 $48 Year 4 $16 $58 a. What are the IRRs of the two projects? b. If your discount rate is 5.2%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRs of the two projects? The IRR for project Ais %. (Round to one decimal place.) The IRR for project B is %. (Round to one decimal place.) b. If your discount rate is 5.2%, what are the NPVs of the two projects? If your discount rate is 5.2%, the NPV for project A is $ million. (Round to two decimal places.) If your discount rate is 5.2%, the NPV for project B is $ million. (Round to two decimal places.) c. Why do IRR and NPV rank the two projects differently? (Select from the drop-down menus.) Vis measuring value creation, while Vis measuring return on investment. Because returns do not scale with different levels of investment, the NPV and IRR rank the two projects differently because they are measuring different things. two measures may give different rankings when the initial investments are different. NPV IRR