Question

You have been offered an investment opportunity that will generate cash flows in the amount of $2000 per year for 5 years, starting in

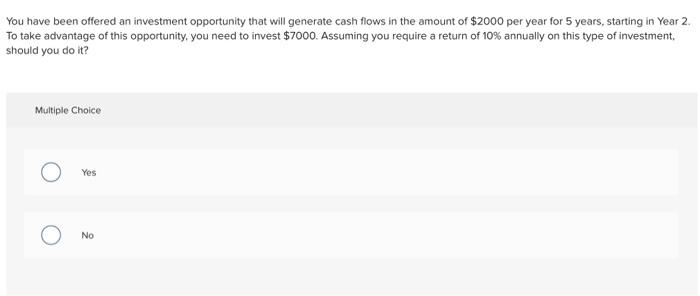

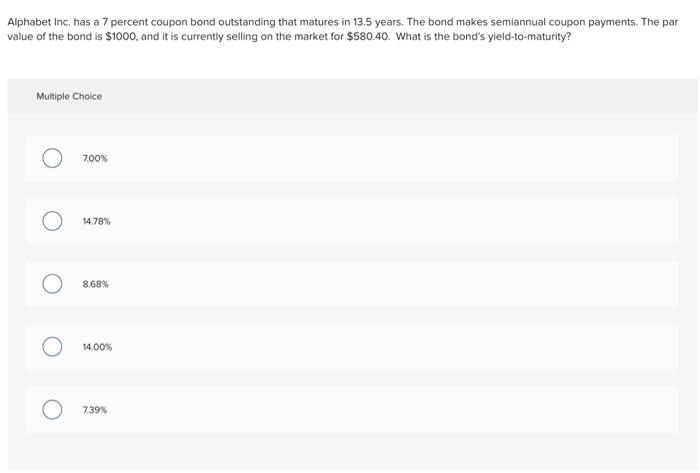

You have been offered an investment opportunity that will generate cash flows in the amount of $2000 per year for 5 years, starting in Year 2. To take advantage of this opportunity, you need to invest $7000. Assuming you require a return of 10% annually on this type of investment, should you do it? Multiple Choice Yes No Alphabet Inc. has a 7 percent coupon bond outstanding that matures in 13.5 years. The bond makes semiannual coupon payments. The par value of the bond is $1000, and it is currently selling on the market for $580.40. What is the bond's yield-to-maturity? Multiple Choice 7.00% 14,78% 8.68% 14.00% 7.39%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Revenve Expected 2000 X 5 10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economy

Authors: Leland T. Blank, Anthony Tarquin

8th edition

73523439, 73523437, 978-0073523439

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App