Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been presented with a working paper calculating planning and performance materiality: table [ [ Planning and performance materiality ] , [ Client:

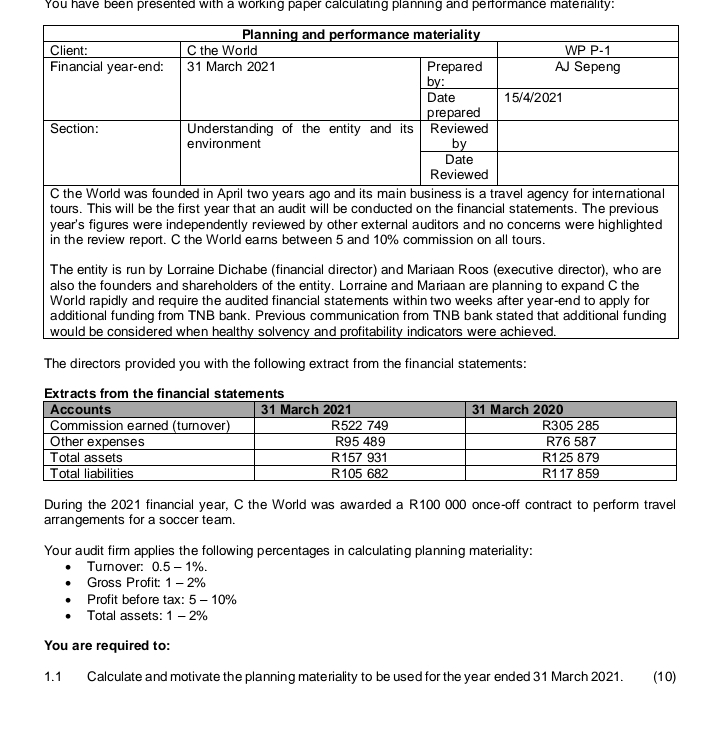

You have been presented with a working paper calculating planning and performance materiality:

tablePlanning and performance materialityClient:C the World,WP PFinancial yearend:, March tablePreparedby:AJ SepengtableDatepreparedSection:tableUnderstanding of the entity and itsenvironmenttableReviewedbytableDateReviewed

tableC the World was founded in April two years ago and its main business is a travel agency for internationaltours This will be the first year that an audit will be conducted on the financial statements. The previousyears figures were independently reviewed by other external auditors and no concerns were highlightedin the review report. C the World earns between and commission on all tours.The entity is run by Lorraine Dichabe financial director and Mariaan Roos executive director who arealso the founders and shareholders of the entity. Lorraine and Mariaan are planning to expand C theWorld rapidly and require the audited financial statements within two weeks after yearend to apply foradditional funding from TNB bank. Previous communication from TNB bank stated that additional fundingwould be considered when healthy solvency and profitability indicators were achieved.

The directors provided you with the following extract from the financial statements:

Extracts from the financial statements

tableAccounts March March Commission earned turnoverRROther expenses,RRTotal assets,RRTotal liabilities,RR

During the financial year, C the World was awarded a R onceoff contract to perform travel arrangements for a soccer team.

Your audit firm applies the following percentages in calculating planning materiality:

Turnover:

Gross Profit:

Profit before tax:

Total assets:

You are required to:

Calculate and motivate the planning materiality to be used for the year ended March

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started