Question

You have been provided with the following data provided by or relating to the pension fund manager or the pension actuary pertaining to BC Co.'s

You have been provided with the following data provided by or relating to the pension fund manager or the pension actuary pertaining to BC Co.'s defined benefit pension plan.

Actuary Assessment Report

1. Long term discount rate applied: 3%; no change from the 2015 plan assessment

2. Current service cost accruing for service years: 2019 - $170,000; 2020: - $180,000 (end of year recognition)

3. Average pensionable group life expectancy decreased by .4 years with an associated adjustment of $300,000 applied at the end of year.

4. Implementation of extended spousal survival pension after death of the pensioned employee, effective January 1, 2020 - $1,345,000

5. Higher employee turnover than that expected in 2015, the last actuarial assessment, for value of $735,000 effective January 1, 2020.

Pension Fund Manager's Report

1. Balance of pension funds at December 31, 2019: $12,750,000

2. Expected/benchmark fund return for the forthcoming year provided at January 1, 2019: 2.8%; January 1, 2020: 3.0% (end of year recognition)

3. Payments to pensioners in 2020: $800,000 (end of year recognition)

4. Dividends, interest and net capital appreciation of the fund for 2020: $430,000 (end of year recognition)

5. Funding to the plan from the company through employee deductions and employer contributions for 2018, assumed effective at the end of 2020: $970,000

From the accounting records, you identify that the accrued pension liability reported in the financial statements of the company at the end of December 31, 2019 is $5,175,000.

Required:1. Prepare all pension related entries, with supporting computations, for the year ended December 31, 2020.

2. Provide the balance, properly classified, described and note referenced, with respect to the pension plan as at December 31, 2020.

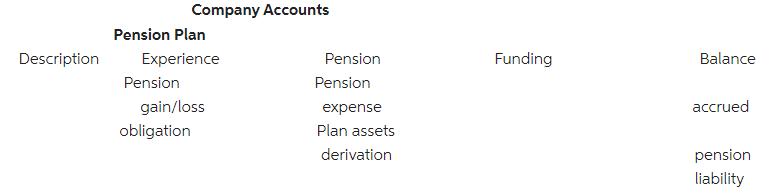

Description Pension Plan Company Accounts Experience Pension gain/loss obligation Pension Pension expense Plan assets derivation Funding Balance accrued pension liability

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The Defined Benefit Asset Liability that the sponsoring company reports is the difference between th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started