Answered step by step

Verified Expert Solution

Question

1 Approved Answer

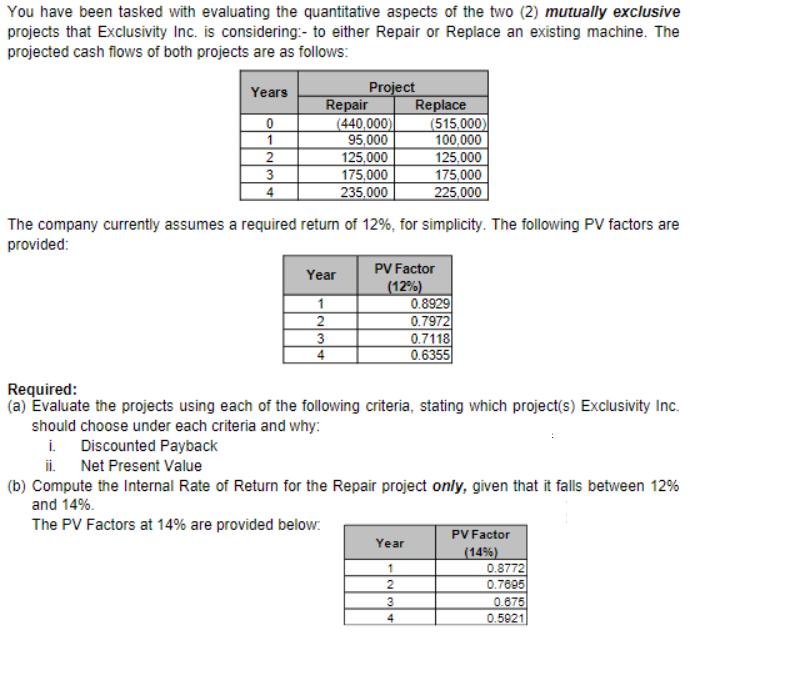

You have been tasked with evaluating the quantitative aspects of the two (2) mutually exclusive projects that Exclusivity Inc. is considering:- to either Repair

You have been tasked with evaluating the quantitative aspects of the two (2) mutually exclusive projects that Exclusivity Inc. is considering:- to either Repair or Replace an existing machine. The projected cash flows of both projects are as follows: Years 0 1 2 3 4 Project Repair (440,000) 95,000 Year 1 2 3 125,000 175,000 235.000 Replace The company currently assumes a required return of 12%, for simplicity. The following PV factors are provided: (515,000) 100,000 125,000 175,000 225.000 PV Factor (12%) Year 1 2 3 4 0.8929 0.7972 0.7118 0.6355 Required: (a) Evaluate the projects using each of the following criteria, stating which project(s) Exclusivity Inc. should choose under each criteria and why: i. Discounted Payback ii. Net Present Value (b) Compute the Internal Rate of Return for the Repair project only, given that it falls between 12% and 14%. The PV Factors at 14% are provided below. PV Factor (14%) 0.8772 0.7895 0.875 0.5921

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part A 1 Step 13 ii Year 0 1 2 3 4 Year Cummulative Cash Flows Repair PVF 12 PV AB 4400...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started