Answered step by step

Verified Expert Solution

Question

1 Approved Answer

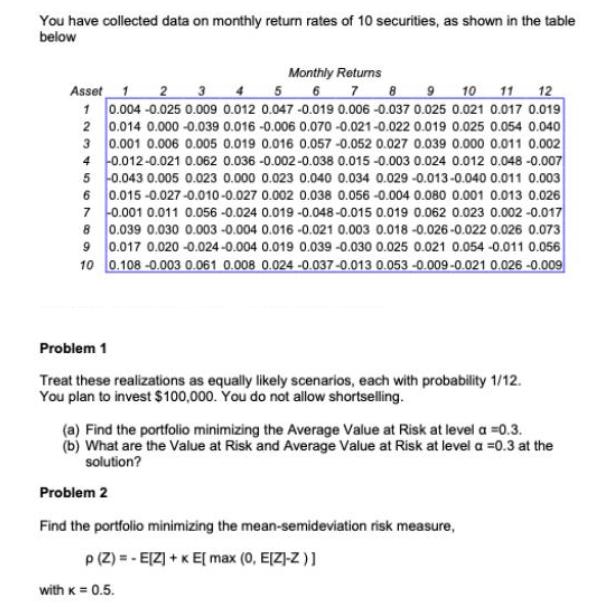

You have collected data on monthly return rates of 10 securities, as shown in the table below Asset 1 2 3 4 5 Monthly

You have collected data on monthly return rates of 10 securities, as shown in the table below Asset 1 2 3 4 5 Monthly Returns 6 7 8 9 10 11 12 0.004 -0.025 0.009 0.012 0.047 -0.019 0.006 -0.037 0.025 0.021 0.017 0.019 0.014 0.000 -0.039 0.016 -0.006 0.070 -0.021-0.022 0.019 0.025 0.054 0.040 3 0.001 0.006 0.005 0.019 0.016 0.057 -0.052 0.027 0.039 0.000 0.011 0.002 4 -0.012-0.021 0.062 0.036 -0.002-0.038 0.015-0.003 0.024 0.012 0.048 -0.007 5 -0.043 0.005 0.023 0.000 0.023 0.040 0.034 0.029 -0.013-0.040 0.011 0.003 0.015-0.027-0.010-0.027 0.002 0.038 0.056 -0.004 0.080 0.001 0.013 0.026 -0.001 0.011 0.056 -0.024 0.019 -0.048-0.015 0.019 0.062 0.023 0.002 -0.017 0.039 0.030 0.003 -0.004 0.016 -0.021 0.003 0.018 -0.026-0.022 0.026 0.073 0.017 0.020 -0.024-0.004 0.019 0.039 -0.030 0.025 0.021 0.054 -0.011 0.056 0.108 -0.003 0.061 0.008 0.024 -0.037-0.013 0.053 -0.009-0.021 0.026 -0.009 1 2 6 7 8 9 10 Problem 1 Treat these realizations as equally likely scenarios, each with probability 1/12. You plan to invest $100,000. You do not allow shortselling. (a) Find the portfolio minimizing the Average Value at Risk at level a =0.3. (b) What are the value at Risk and Average Value at Risk at level a =0.3 at the solution? Problem 2 Find the portfolio minimizing the mean-semideviation risk measure, p (Z) = - E[Z] + K E[max (0, E[Z]-Z)] with K = 0.5.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The image youve provided contains a table with monthly return rates of 10 securities as well as two problem statements related to portfolio management ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started