Question

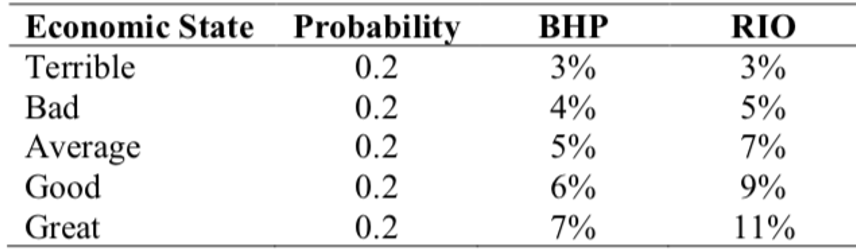

You have estimated the following probabilities for the returns of BHP and RIO in five different states of the economy: a) Calculate the mean and

You have estimated the following probabilities for the returns of BHP and RIO in five different states of the economy:

a) Calculate the mean and standard deviation of returns for the two firms.

b) Plot both BHP and RIO on a chart where return is on the y-axis and standard deviation is on the x-axis. Using indifference curves, show on the graph the following three types of investors

i) William is indifferent between BHP and RIO

ii) Eugene prefers BHP to RIO iii) Merton prefers RIO to BHP

c) Can all three investors be acting rationally? Discuss with reference to the risk and return of both BHP and RIO, and the critical assumption underlying mean-variance analysis.

Economic State Probability Terrible 0.2 Bad 0.2 Average 0.2 Good 0.2 Great 0.2 BHP 3% 4% 5% 6% 7% RIO 3% 5% 7% 9% 11%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started