Question

You have estimated the historical relationship between stock ITTs return and market return using a single-index model with daily return data: r = 0.1% +

You have estimated the historical relationship between stock ITTs return and market return using a single-index model with daily return data:

r = 0.1% + 1.5rM

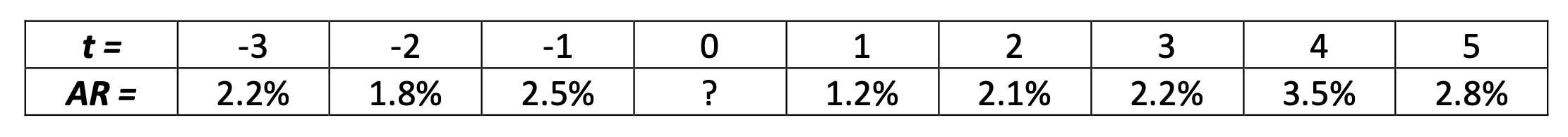

On the announcement date (t=0) of ITTs earnings, its return was 5.5% while the market return was 2%. Your assistant has worked out the remaining abnormal returns (AR) for ITT surrounding the announcement date (t=0).

Required:

-

(1) Calculate the abnormal return for ITT on t=0. Does the market perceive the earnings announcement as good news? [4 marks]

-

(2) Calculate cumulative abnormal return CAR from t=1 to t=5. Does CAR[1, 5] violate the semi-strong form of market efficiency? Explain. [4 marks]

-

(3) Does CAR[-3, -1] violate the semi-strong form of market efficiency? Explain. [3 marks]

-

(4) If you believe the above pattern of abnormal returns is caused by market inefficiency, how would you design a trading strategy to exploit the inefficiency? [3 marks]

-

(5) Discuss how Prospect Theory may help explain why momentum strategy works?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started