Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have gathered the following information from Siyabonga and Amahle Ndlovu: Mr Siyabonga Ndlovu is 4 5 years old Mrs Amahle Ndlovu is 4 0

You have gathered the following information from Siyabonga and Amahle Ndlovu:

Mr Siyabonga Ndlovu is years old

Mrs Amahle Ndlovu is years old

They are married out of community of property, with the inclusion of the accrual system.

Mr and Mrs Ndlovu have a daughter aged Lesedi and a son of Junior Lesedi was involved in

a car accident and she will be paraplegic for the rest of her life. Junior supports himself.

Mr Ndlovu is an employee of Ndlovu Brothers Pty Ltd He is not a member of a medical scheme and is

thinking of becoming a member. He has never been on a medical aid in his life. He is unsure if there is

any benefit in making his spouse the principal member of the medical aid. His wife was on a scheme for

her whole life until two months ago when she changed bank accounts and forgot to inform the scheme.

As a result of her negligence her membership was terminated.

They have been married for years. When they got married the value of his estate was worth R

and her estate was worth R The CPI factors at date of marriage and currently is and

respectively. Their antenuptial contract agreement states that her investments are excluded from the

accrual.

Mr Siyabonga Ndlovu has the following assets and liabilities:

He also has a fiduciary interest over a holiday flat in Port St Johns. The current market value is R

The fideicommissary is his youngest brother Mpho Ndlovu who has just turned

Mrs Amahle Ndlovu has the following assets and liabilities:

Trusts

The Ndlovu Family Trust, established in South Africa in has the following assets and liabilities:

Life policy on the life of Mr Ndlovu Value R

Shares of Ndlovu Brothers Pty Ltd Value R

The trust deed states that the trustees of the trust are Mr Ndlovu, Mrs Ndlovu and his older brother who is

resident in Dubai. It is a discretionary trust and the beneficiaries are his children.

Business interests

The other two shareholders of Ndlovu Brothers Pty Ltd affected a policy in their personal capacity on the

life of Mr Ndlovu for an amount of R There is no written agreement and Mr Ndlovu informs you

that they indicated that they will not purchase the shares from his trust on his death. They will keep the proceeds of the policy for themselves. He is concerned about the estate duty and CGT implications.

Last Will and Testament

Mr Ndlovu bequeaths the following:

R cash and the unit trusts CIS to the trust.

The residue of the estate to the spouse.

In the event of his spouse predeceasing him, the whole of his estate is bequeathed to the inter vivos trust.

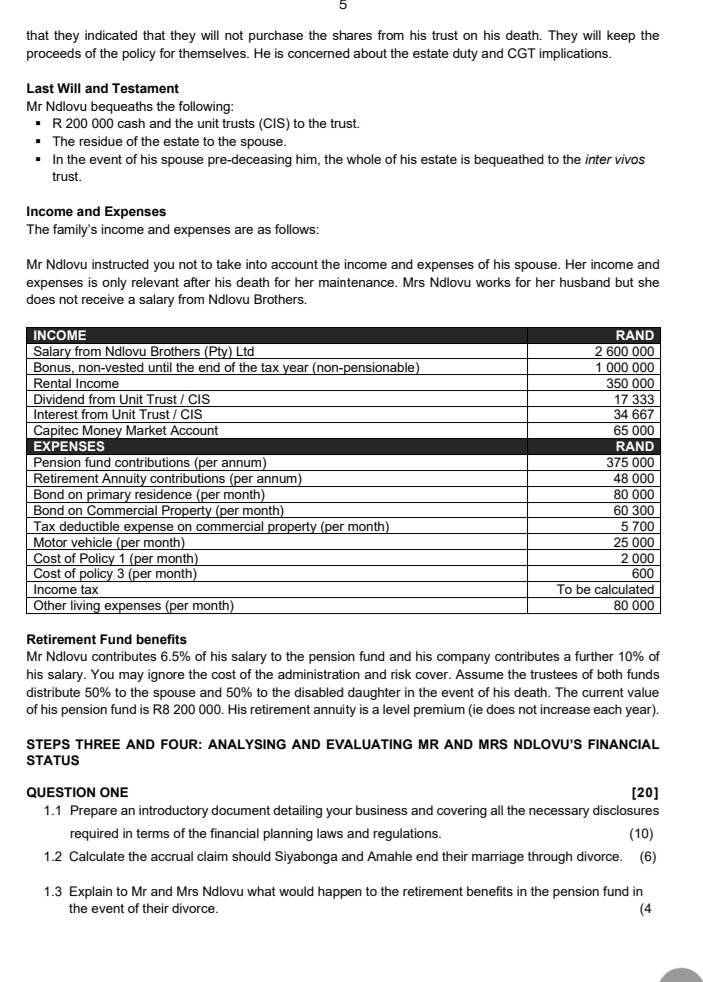

Income and Expenses

The family's income and expenses are as follows:

Mr Ndlovu instructed you not to take into account the income and expenses of his spouse. Her income and expenses is only relevant after his death for her maintenance. Mrs Ndlovu works for her husband but she does not receive a salary from Ndlovu Brothers.

tableINCOMERANDSalary from Ndlovu Brothers Pty LtdBonus nonvested until the end of the tax year nonpensionableRental Income,Dividend from Unit Trust CIS,Interest from Unit Trust CIS,Capitec Money Market Account,EXPENSESRANDPension fund contributions per annumRetirement Annuity contributions per annumBond on primary residence per monthBond on Commercial Property per monthTax deductible expense on commercial property per monthMotor vehicle per monthCost of Policy per monthCost of policy per monthIncome tax,To be calculatedOther living expenses per month

Retirement Fund benefits

Mr Ndlovu contributes of his salary to the pension fund and his company contributes a further of his salary. You may ignore the cost of the administration and risk cover. Assume the trustees of both funds distribute to the spouse and to the disabled daughter in the event of his death. The current value of his pension fund is R His retirement annuity is a level premium ie does not increase each year

STEPS THREE AND FOUR: ANALYSING AND EVALUATING MR AND MRS NDLOVU'S FINANCIAL STATUS

QUESTION ONE

Prepare an introductory document detailing your business and covering all the necessary disclosures required in terms of the financial planning laws and regulations.

Calculate the accrual claim should Siyabonga and Amahle end their marriage through divorce.

Explain to Mr and Mrs Ndlovu what would happen to the retirement benefits in the pension fund in the event of their divorce.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started