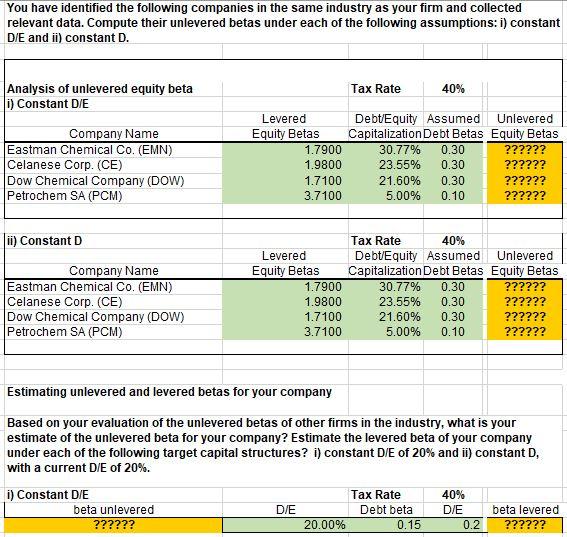

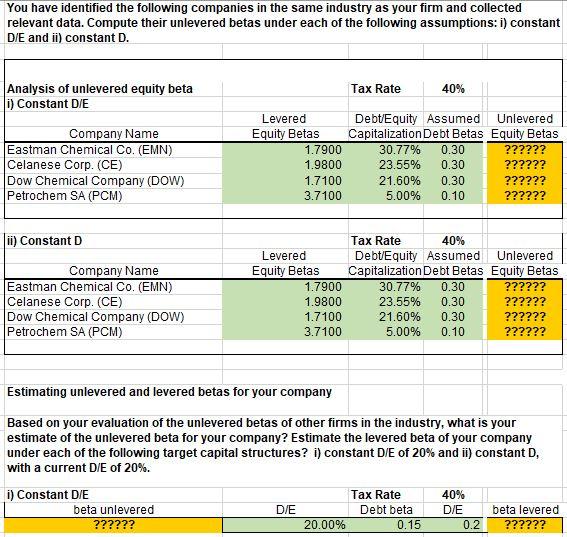

You have identified the following companies in the same industry as your firm and collected relevant data. Compute their unlevered betas under each of the following assumptions: i) constant D/E and ii) constant D. Tax Rate 40% Analysis of unlevered equity beta i) Constant DIE Company Name Eastman Chemical Co. (EMN) Celanese Corp. (CE) Dow Chemical Company (DOW) Petrochem SA (PCM) Levered Equity Betas 1.7900 1.9800 1.7100 3.7100 Debt/Equity Assumed Unlevered Capitalization Debt Betas Equity Betas 30.77% 0.30 ?????? 23.55% 0.30 ?????? 21.60% 0.30 ?????? 5.00% 0.10 ?????? ii) Constant D Company Name Eastman Chemical Co. (EMN) Celanese Corp. (CE) Dow Chemical Company (DOW) Petrochem SA (PCM) Levered Equity Betas 1.7900 1.9800 1.7100 3.7100 Tax Rate 40% Debt/Equity Assumed Unlevered Capitalization Debt Betas Equity Betas 30.77% 0.30 ?????? 23.55% 0.30 ?????? 21.60% 0.30 ?????? 5.00% 0.10 ?????? Estimating unlevered and levered betas for your company Based on your evaluation of the unlevered betas of other firms in the industry, what is your estimate of the unlevered beta for your company? Estimate the levered beta of your company under each of the following target capital structures? i) constant D/E of 20% and ii) constant D, with a current D/E of 20%. i) Constant D/E beta unlevered ?????? DIE Tax Rate Debt beta 20.00% 0.15 40% D/E 0.2 beta levered ?????? You have identified the following companies in the same industry as your firm and collected relevant data. Compute their unlevered betas under each of the following assumptions: i) constant D/E and ii) constant D. Tax Rate 40% Analysis of unlevered equity beta i) Constant DIE Company Name Eastman Chemical Co. (EMN) Celanese Corp. (CE) Dow Chemical Company (DOW) Petrochem SA (PCM) Levered Equity Betas 1.7900 1.9800 1.7100 3.7100 Debt/Equity Assumed Unlevered Capitalization Debt Betas Equity Betas 30.77% 0.30 ?????? 23.55% 0.30 ?????? 21.60% 0.30 ?????? 5.00% 0.10 ?????? ii) Constant D Company Name Eastman Chemical Co. (EMN) Celanese Corp. (CE) Dow Chemical Company (DOW) Petrochem SA (PCM) Levered Equity Betas 1.7900 1.9800 1.7100 3.7100 Tax Rate 40% Debt/Equity Assumed Unlevered Capitalization Debt Betas Equity Betas 30.77% 0.30 ?????? 23.55% 0.30 ?????? 21.60% 0.30 ?????? 5.00% 0.10 ?????? Estimating unlevered and levered betas for your company Based on your evaluation of the unlevered betas of other firms in the industry, what is your estimate of the unlevered beta for your company? Estimate the levered beta of your company under each of the following target capital structures? i) constant D/E of 20% and ii) constant D, with a current D/E of 20%. i) Constant D/E beta unlevered ?????? DIE Tax Rate Debt beta 20.00% 0.15 40% D/E 0.2 beta levered