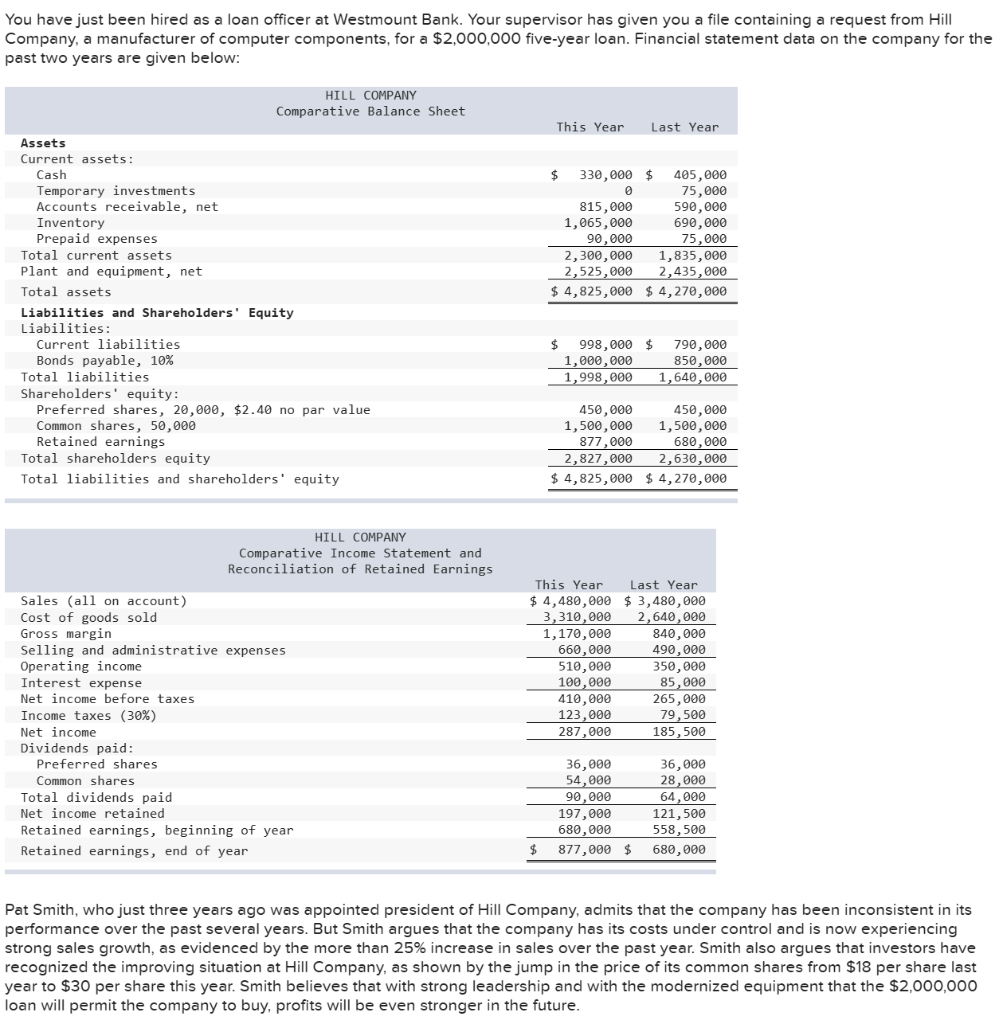

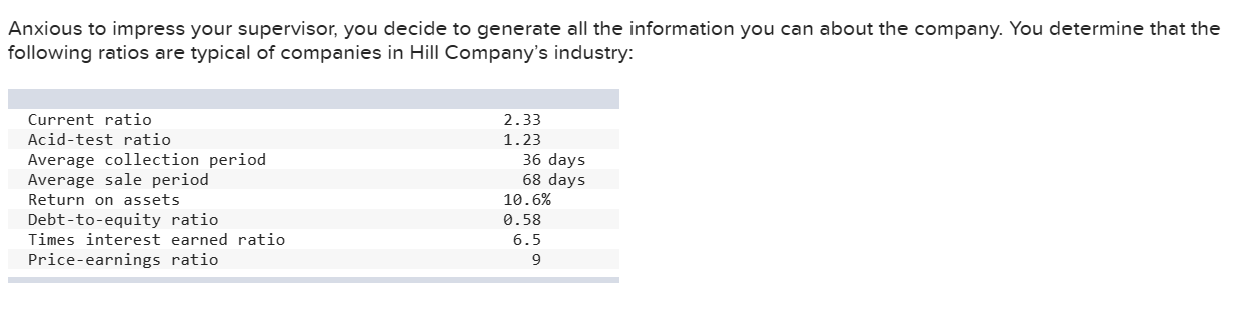

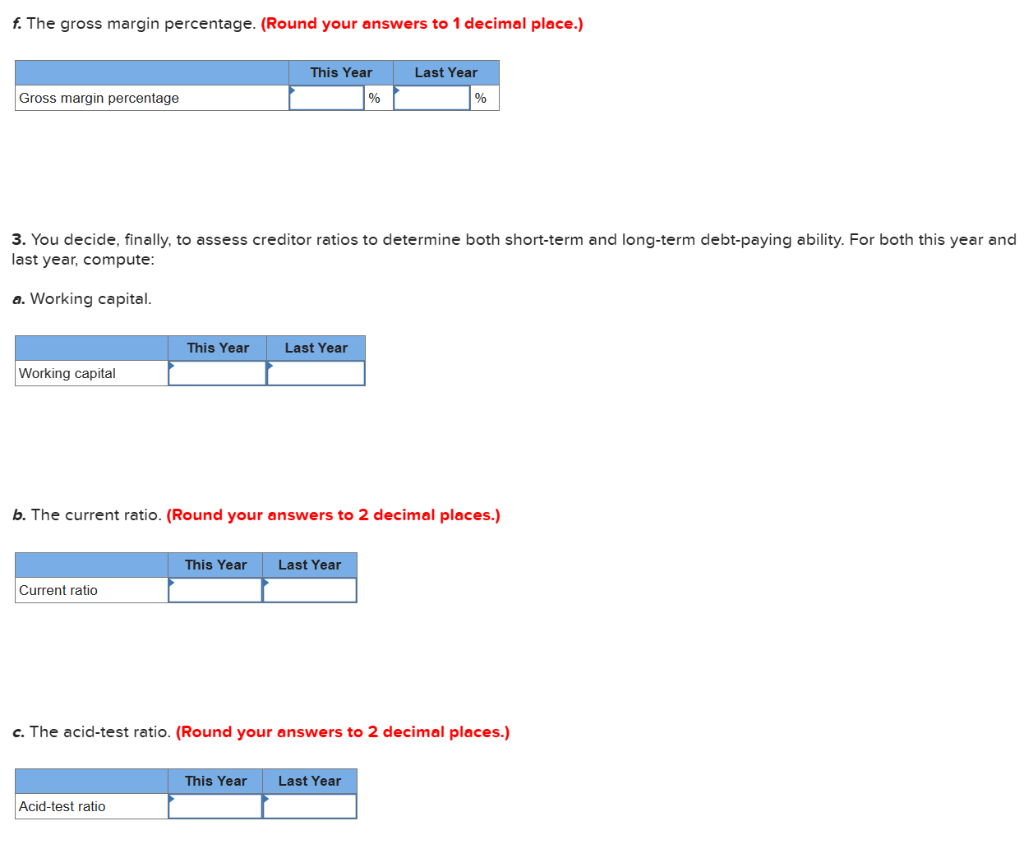

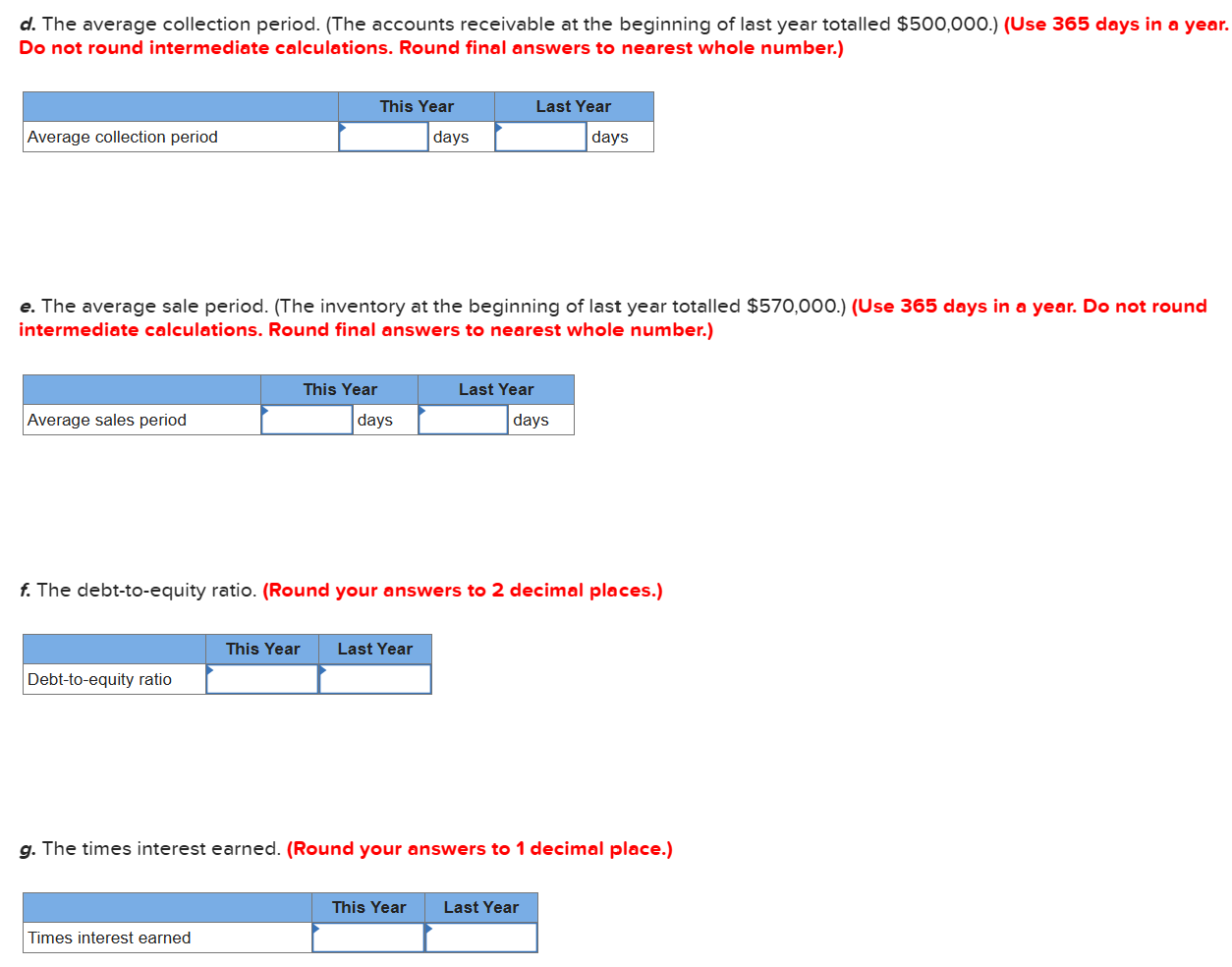

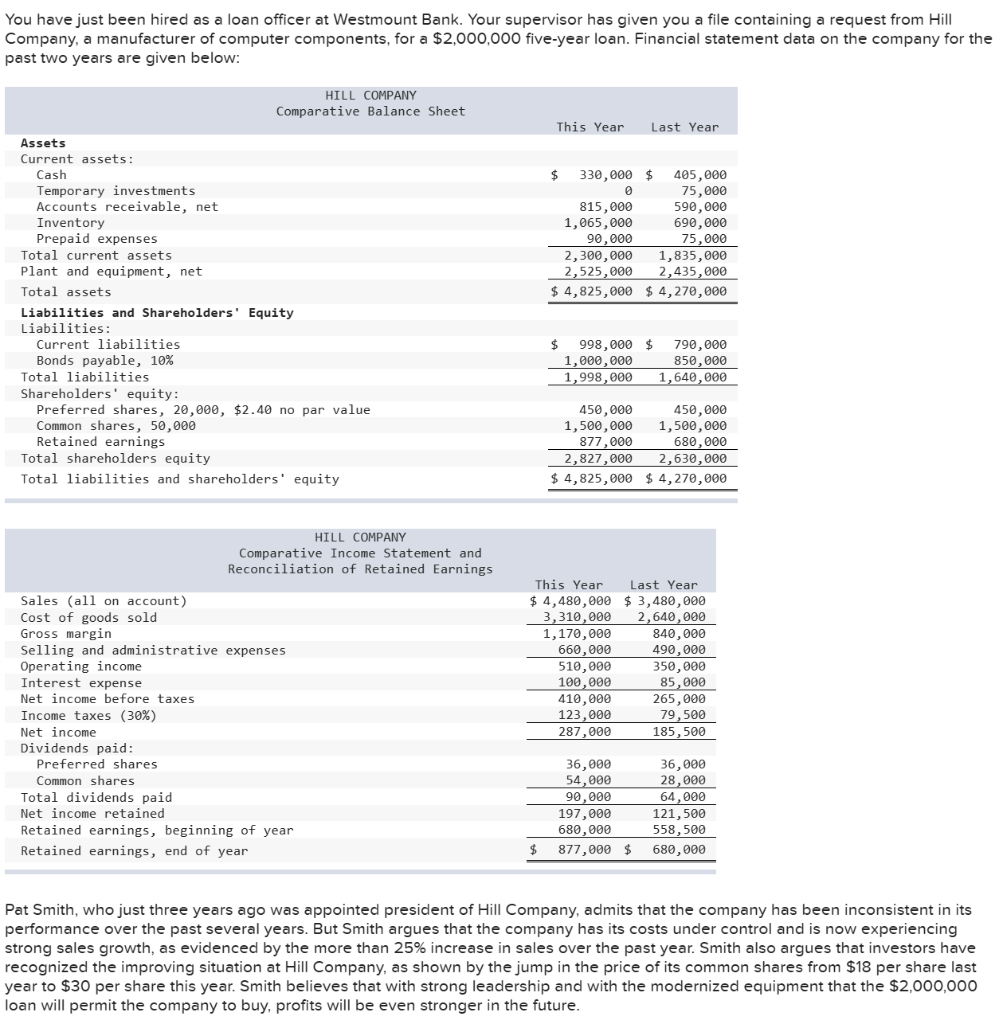

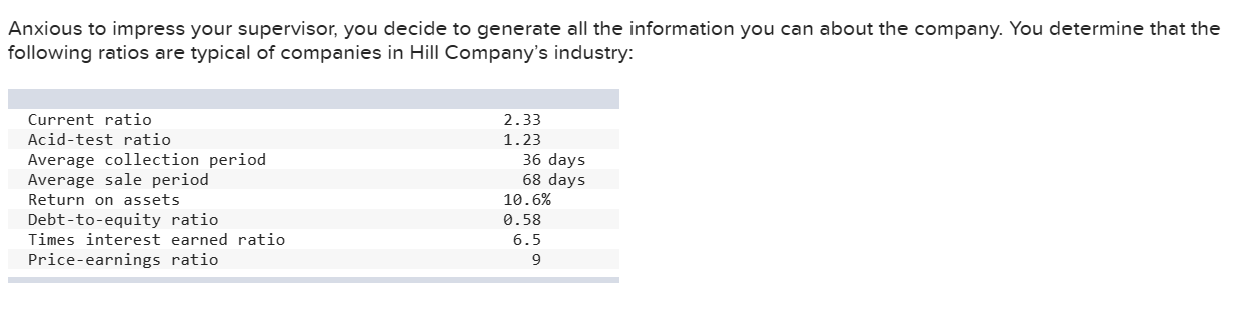

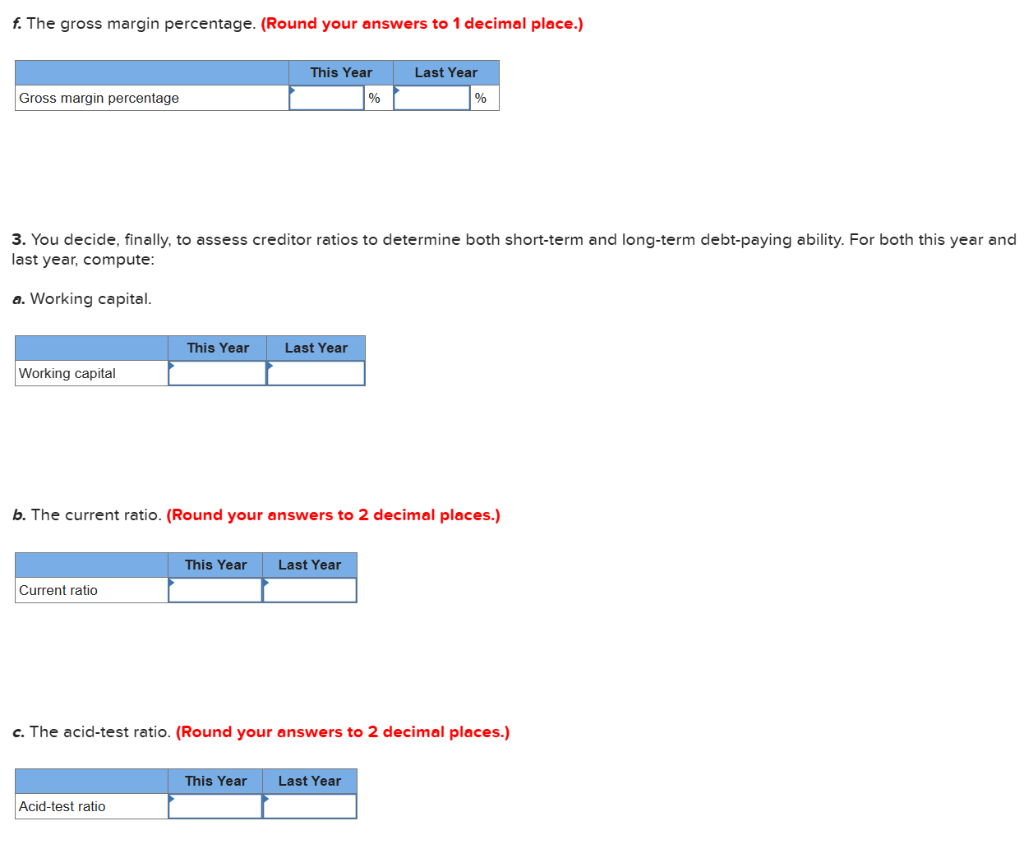

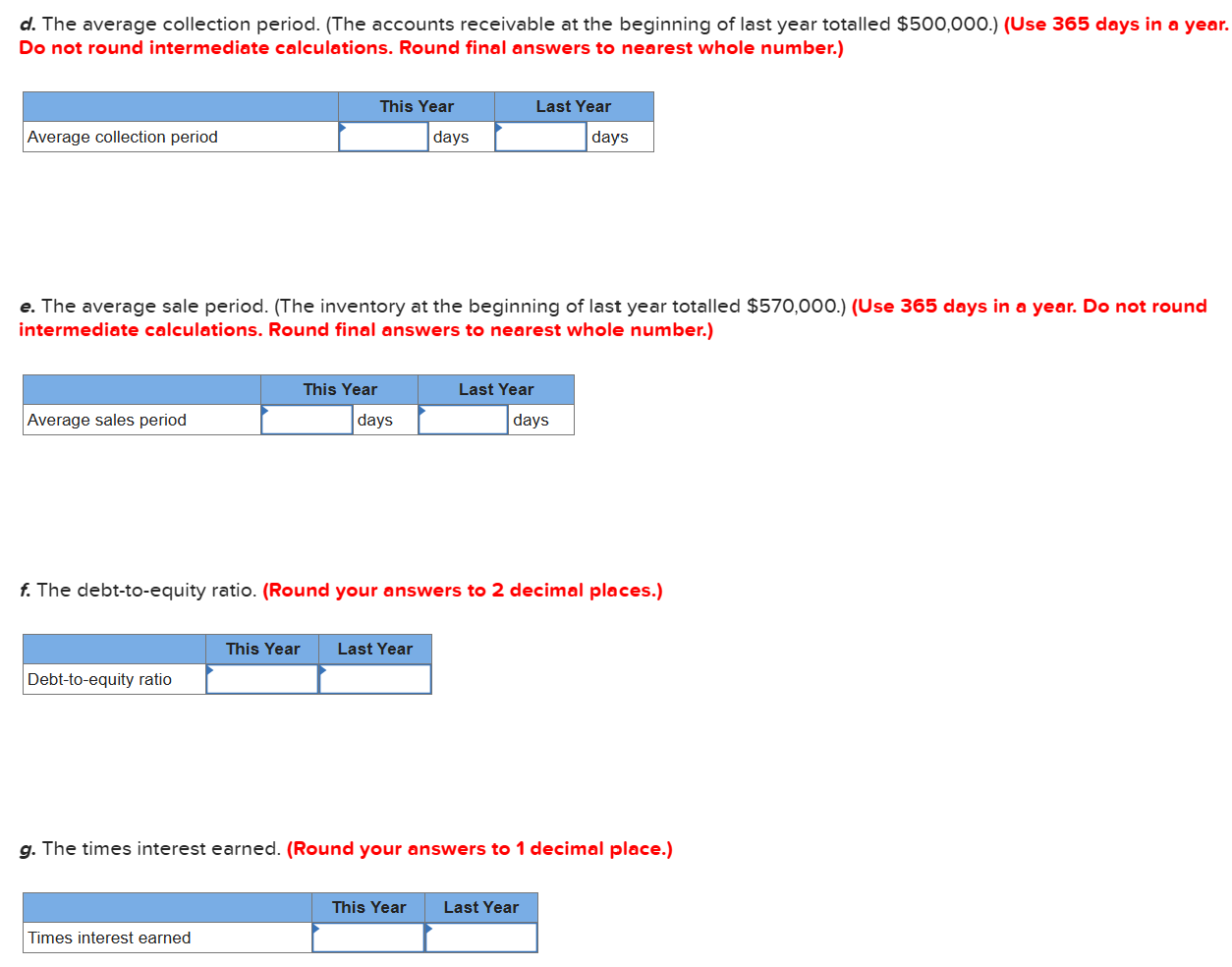

You have just been hired as a loan officer at Westmount Bank. Your supervisor has given you a file containing a request from Hill Company, a manufacturer of computer components, for a $2,000,000 five-year loan. Financial statement data on the company for the past two years are given below: Pat Smith, who just three years ago was appointed president of Hill Company, admits that the company has been inconsistent in its performance over the past several years. But Smith argues that the company has its costs under control and is now experiencing strong sales growth, as evidenced by the more than 25% increase in sales over the past year. Smith also argues that investors have recognized the improving situation at Hill Company, as shown by the jump in the price of its common shares from $18 per share last year to $30 per share this year. Smith believes that with strong leadership and with the modernized equipment that the $2,000,000 loan will permit the company to buy, profits will be even stronger in the future. Anxious to impress your supervisor, you decide to generate all the information you can about the company. You determine that the following ratios are typical of companies in Hill Company's industry: f. The gross margin percentage. (Round your answers to 1 decimal place.) 3. You decide, finally, to assess creditor ratios to determine both short-term and long-term debt-paying ability. For both this year and last year, compute: a. Working capital. b. The current ratio. (Round your answers to 2 decimal places.) c. The acid-test ratio. (Round your answers to 2 decimal places.) d. The average collection period. (The accounts receivable at the beginning of last year totalled $500,000.) (Use 365 days in a year. Do not round intermediate calculations. Round final answers to nearest whole number.) e. The average sale period. (The inventory at the beginning of last year totalled $570,000.) (Use 365 days in a year. Do not round intermediate calculations. Round final answers to nearest whole number.) f. The debt-to-equity ratio. (Round your answers to 2 decimal places.) g. The times interest earned. (Round your answers to 1 decimal place.)