Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just been hired as the new Financial Manager of an enterprise. Your office needs new modernized equipment which costs a total of Ten

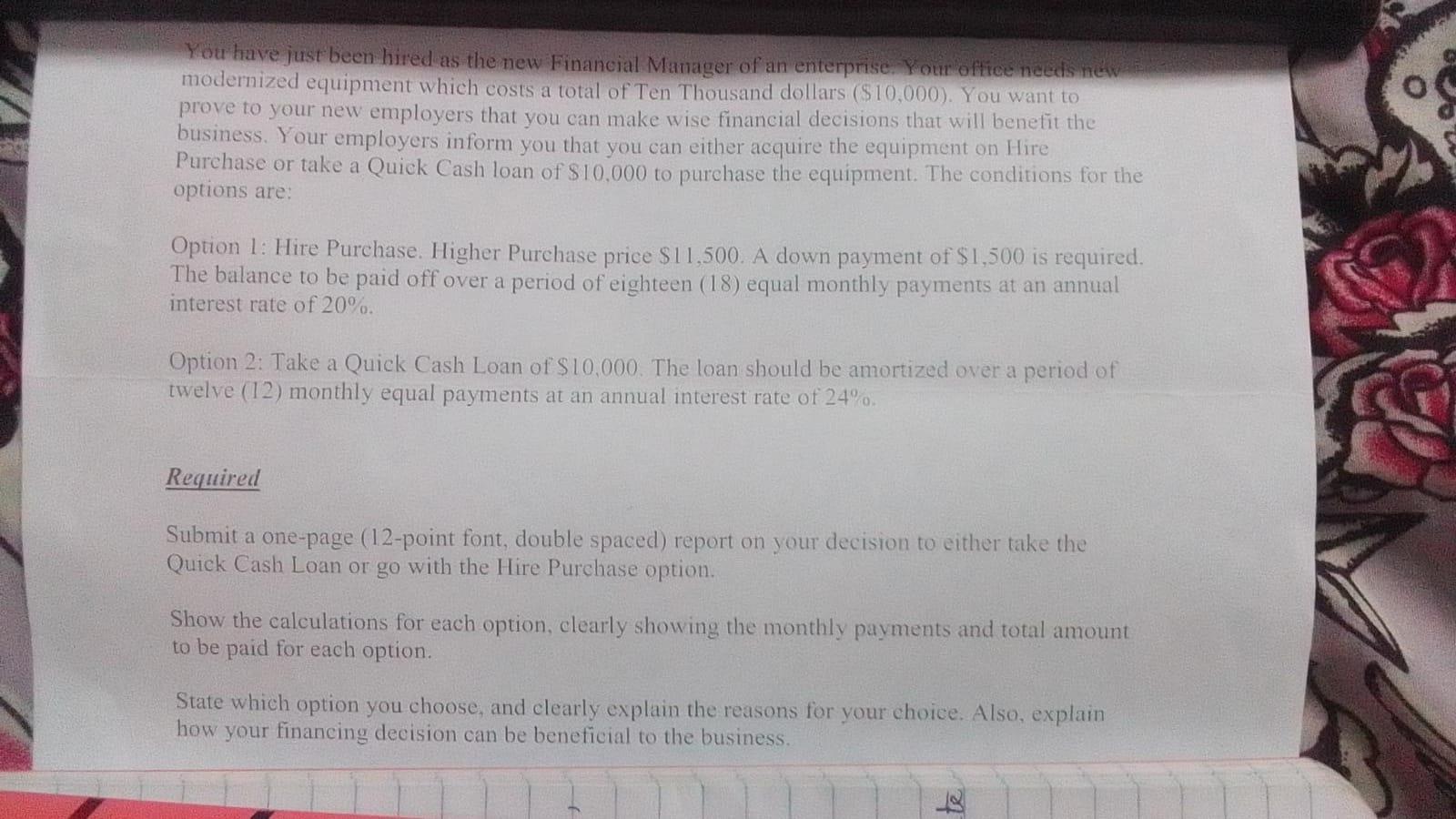

You have just been hired as the new Financial Manager of an enterprise. Your office needs new modernized equipment which costs a total of Ten Thousand dollars ($10,000). You want to prove to your new employers that you can make wise financial decisions that will benefit the business. Your employers inform you that you can either acquire the equipment on Hire Purchase or take a Quick Cash loan of $10,000 to purchase the equipment. The conditions for the options are: Option 1: Hire Purchase. Higher Purchase price $11,500. A down payment of $1,500 is required. The balance to be paid off over a period of eighteen (18) equal monthly payments at an annual interest rate of 20%. Option 2: Take a Quick Cash Loan of $10,000. The loan should be amortized over a period of twelve (12) monthly equal payments at an annual interest rate of 24%. Required Submit a one-page (12-point font, double spaced) report on your decision to either take the Quick Cash Loan or go with the Hire Purchase option. Show the calculations for each option, clearly showing the monthly payments and total amount to be paid for each option. State which option you choose, and clearly explain the reasons for your choice. Also, explain how your financing decision can be beneficial to the business. You have just been hired as the new Financial Manager of an enterprise. Your office needs new modernized equipment which costs a total of Ten Thousand dollars ($10,000). You want to prove to your new employers that you can make wise financial decisions that will benefit the business. Your employers inform you that you can either acquire the equipment on Hire Purchase or take a Quick Cash loan of $10,000 to purchase the equipment. The conditions for the options are: Option 1: Hire Purchase. Higher Purchase price $11,500. A down payment of $1,500 is required. The balance to be paid off over a period of eighteen (18) equal monthly payments at an annual interest rate of 20%. Option 2: Take a Quick Cash Loan of $10,000. The loan should be amortized over a period of twelve (12) monthly equal payments at an annual interest rate of 24%. Required Submit a one-page (12-point font, double spaced) report on your decision to either take the Quick Cash Loan or go with the Hire Purchase option. Show the calculations for each option, clearly showing the monthly payments and total amount to be paid for each option. State which option you choose, and clearly explain the reasons for your choice. Also, explain how your financing decision can be beneficial to the business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started