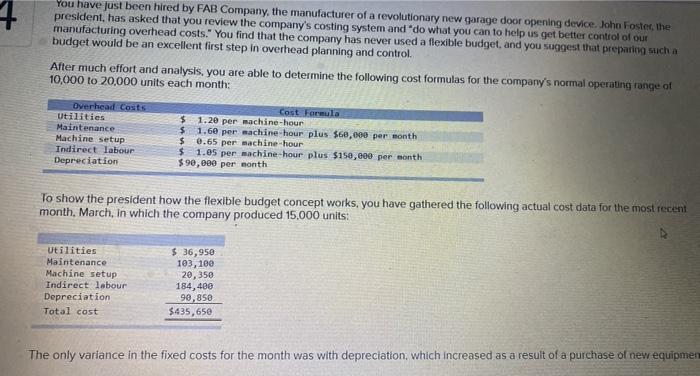

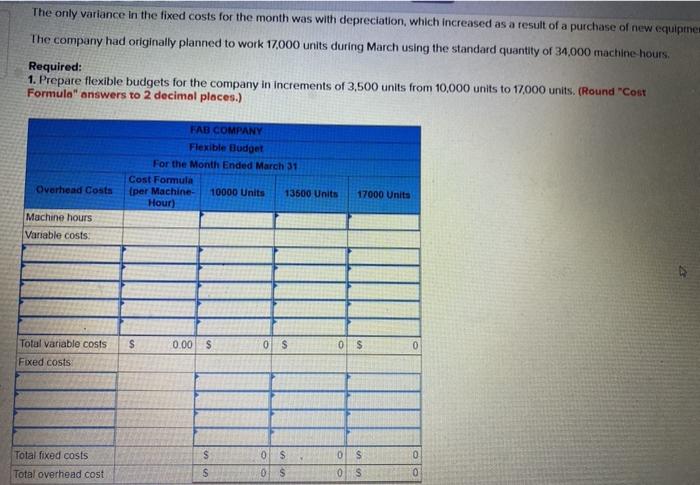

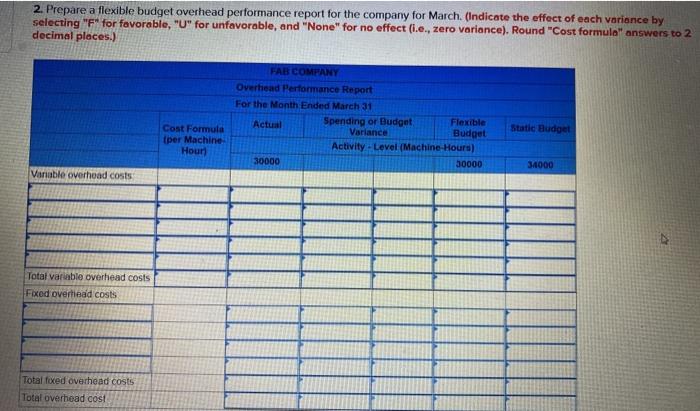

You have just been hired by FAB Company, the manufacturer of a revolutionary new garage door opening device. John Foster, the president, has asked that you review the company's costing system and do what you can to help us get better control of our manufacturing overhead costs." You find that the company has never used a flexible budget, and you suggest that preparing such a budget would be an excellent first step in overhead planning and control. After much effort and analysis, you are able to determine the following cost formulas for the company's normal operating range of 10,000 to 20,000 units each month: Overhead Costs Utilities Maintenance Machine setup Indirect labour Depreciation Cost Formula $ 1.20 per machine-hour $ 1.60 per machine-hour plus $68,000 per month $ 0.65 per machine-hour $ 1.05 per machine-hour plus $150,000 per month $90,000 per month To show the president how the flexible budget concept works, you have gathered the following actual cost data for the most recent month, March, in which the company produced 15,000 units: Utilities Maintenance Machine setup Indirect labour Depreciation Total cost $ 36,950 103,100 20, 350 184,400 90,850 $435,650 The only variance in the fixed costs for the month was with depreciation, which increased as a result of a purchase of new equipmen The only variance in the fixed costs for the month was with depreciation, which increased as a result of a purchase of new equipmen The company had originally planned to work 17,000 units during March using the standard quantity of 34,000 machine hours. Required: 1. Prepare flexible budgets for the company in increments of 3,500 units from 10,000 units to 17,000 units. (Round "Cost Formula" answers to 2 decimal places.) FAB COMPANY Flexible Budget For the Month Ended March 31 Cost Formula (per Machine 10000 Units 13500 Units Hour) Overhead Costs 17000 Units Machine hours Variable costs S 0.00 $ 0 $ OS 0 Totul variable costs Fixed costs 0 Total fixed costs Total overhead cost S S 0 $ 0$ 0 S 0 S 2. Prepare a flexible budget overhead performance report for the company for March. (Indicate the effect of each variance by selecting "F* for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Round "Cost formula" answers to 2 decimal places.) FAB COMPANY Overhead Performance Report For the Month Ended March 31 Actual Spending or Budget Flexible Variance Budget Activity - Level (Machine Hours) 30000 30000 Static Budget Cost Formula per Machine Houn 34000 Vanable overhead costs Total variable overhead costs Fixed overtinad costs Total fixed overhead costs Total overhead cost