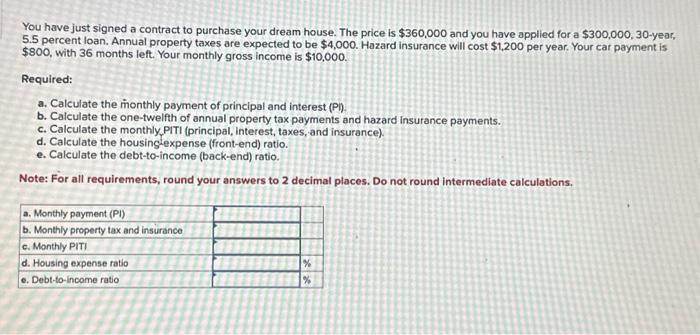

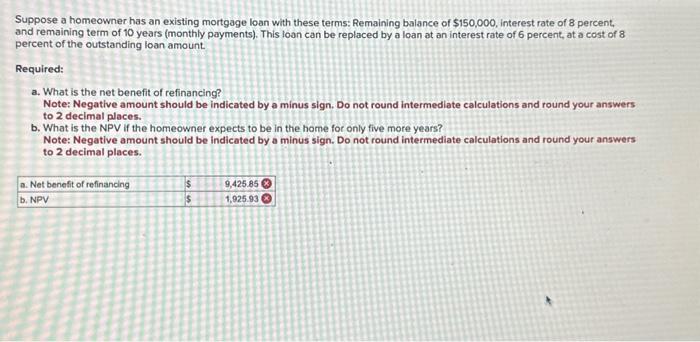

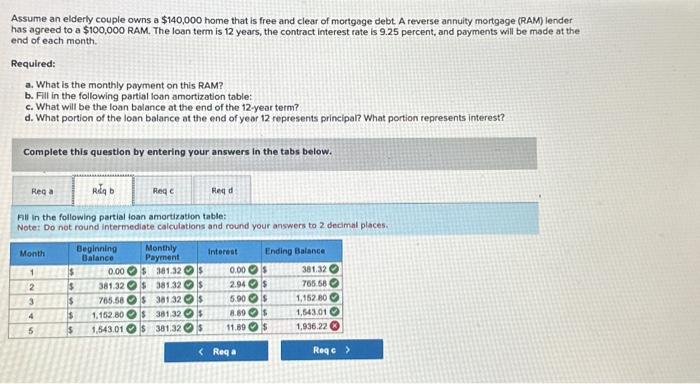

You have just signed a contract to purchase your dream house. The price is $360,000 and you have applied for a $300,000,30year, 5.5 percent loan. Annual property taxes are expected to be $4,000. Hazard insurance will cost $1,200 per year. Your car payment is $800, with 36 months left. Your monthly gross income is $10,000. Required: a. Calculate the monthly payment of principal and interest (P). b. Calculate the one-twelfth of annual property tax payments and hazard insurance payments. c. Calculate the monthly PITI (principal, interest, taxes, and insurance). d. Calculate the housinglexpense (front-end) ratio. e. Calculate the debt-to-income (back-end) ratio. Note: For all requirements, round your answers to 2 decimal places. Do not round intermediate calculations. Suppose a homeowner has an existing mortgage loan with these terms: Remaining balance of $150,000, interest rate of 8 percent, and remaining term of 10 years (monthly payments). This loan can be replaced by a loan at an interest rate of 6 percent, at a cost of 8 percent of the outstanding loan amount Required: a. What is the net benefit of refinancing? Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places. b. What is the NPV if the homeowner expects to be in the home for only five more years? Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places. Assume an elderly couple owns a $140,000 home that is free and clear of mortgage debt A reverse annuity mortgage (RAM) lender has agreed to a $100,000 RAM. The loan term is 12 years, the contract interest rate is 9.25 percent, and payments will be made at the end of each month. Required: a. What is the monthly payment on this RAM? b. FIIt in the following partial loan amortization table: c. What will be the loan bolance at the end of the 12 -year term? d. What portion of the loan balance at the end of year 12 represents principal? What portion represents interest? Complete this question by entering your answers in the tabs below. Fill in the following partial toan amortization table: All in the following partial foan amortization tabie: Notet Do not round intermediate calculations and round your answers to 2 decimal places. You have just signed a contract to purchase your dream house. The price is $360,000 and you have applied for a $300,000,30year, 5.5 percent loan. Annual property taxes are expected to be $4,000. Hazard insurance will cost $1,200 per year. Your car payment is $800, with 36 months left. Your monthly gross income is $10,000. Required: a. Calculate the monthly payment of principal and interest (P). b. Calculate the one-twelfth of annual property tax payments and hazard insurance payments. c. Calculate the monthly PITI (principal, interest, taxes, and insurance). d. Calculate the housinglexpense (front-end) ratio. e. Calculate the debt-to-income (back-end) ratio. Note: For all requirements, round your answers to 2 decimal places. Do not round intermediate calculations. Suppose a homeowner has an existing mortgage loan with these terms: Remaining balance of $150,000, interest rate of 8 percent, and remaining term of 10 years (monthly payments). This loan can be replaced by a loan at an interest rate of 6 percent, at a cost of 8 percent of the outstanding loan amount Required: a. What is the net benefit of refinancing? Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places. b. What is the NPV if the homeowner expects to be in the home for only five more years? Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places. Assume an elderly couple owns a $140,000 home that is free and clear of mortgage debt A reverse annuity mortgage (RAM) lender has agreed to a $100,000 RAM. The loan term is 12 years, the contract interest rate is 9.25 percent, and payments will be made at the end of each month. Required: a. What is the monthly payment on this RAM? b. FIIt in the following partial loan amortization table: c. What will be the loan bolance at the end of the 12 -year term? d. What portion of the loan balance at the end of year 12 represents principal? What portion represents interest? Complete this question by entering your answers in the tabs below. Fill in the following partial toan amortization table: All in the following partial foan amortization tabie: Notet Do not round intermediate calculations and round your answers to 2 decimal places