Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have landed your first full-time engineering job which you will start this month. Your company offers to match your retirement savings, up to

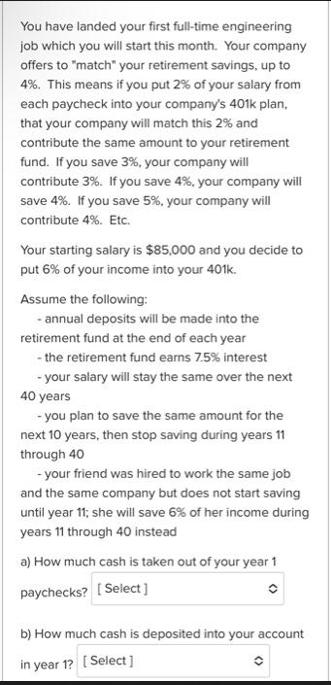

You have landed your first full-time engineering job which you will start this month. Your company offers to "match" your retirement savings, up to 4%. This means if you put 2% of your salary from each paycheck into your company's 401k plan, that your company will match this 2% and contribute the same amount to your retirement fund. If you save 3%, your company will contribute 3%. If you save 4%, your company will save 4%. If you save 5%, your company will contribute 4%. Etc. Your starting salary is $85,000 and you decide to put 6% of your income into your 401k. Assume the following: -annual deposits will be made into the retirement fund at the end of each year - the retirement fund earns 7.5% interest - your salary will stay the same over the next 40 years - you plan to save the same amount for the next 10 years, then stop saving during years 11 through 40 - your friend was hired to work the same job and the same company but does not start saving until year 11; she will save 6% of her income during years 11 through 40 instead a) How much cash is taken out of your year 1 paychecks? [Select] b) How much cash is deposited into your account in year 1? [Select] c) How much money is in your account in year 10? [ Select] d) How much money is in your account in year 40? [Select] e) How much money is in your friend's account in year 40? [Select] f) Who had the better investing strategy, you or your friend? [Select]

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Determine how much cash is taken out of your year 1 paychecks Starting salary 85000 Your contribution 6 of 85000 5100 Company match Based on the giv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started