Answered step by step

Verified Expert Solution

Question

1 Approved Answer

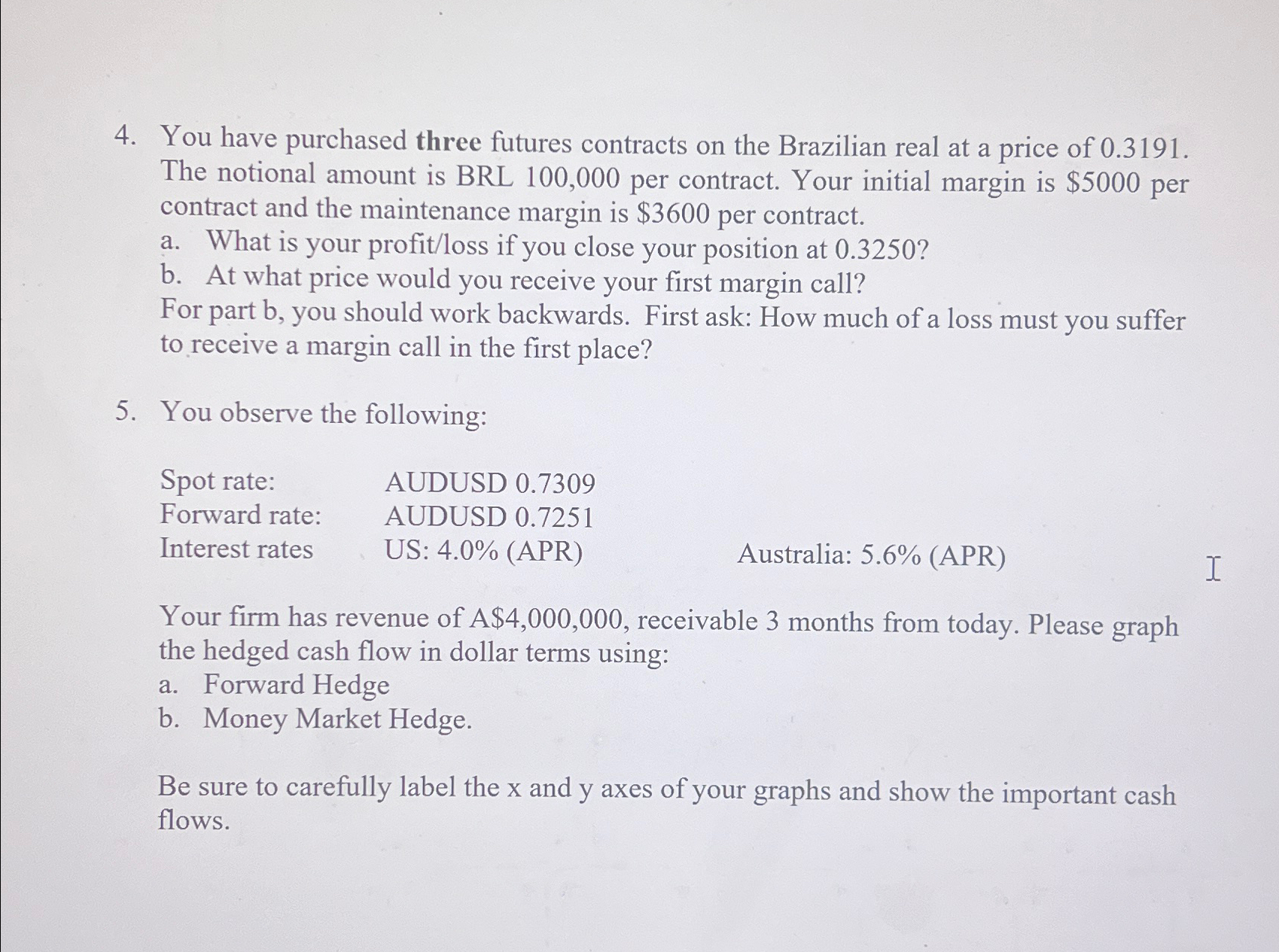

You have purchased three futures contracts on the Brazilian real at a price of 0 . 3 1 9 1 . The notional amount is

You have purchased three futures contracts on the Brazilian real at a price of The notional amount is BRL per contract. Your initial margin is $ per contract and the maintenance margin is $ per contract.

a What is your profitloss if you close your position at

b At what price would you receive your first margin call?

For part b you should work backwards. First ask: How much of a loss must you suffer to receive a margin call in the first place?

You observe the following:

Spot rate: AUDUSD

Forward rate: AUDUSD

Interest rates US: Australia:APR

Your firm has revenue of $ receivable months from today. Please graph the hedged cash flow in dollar terms using:

a Forward Hedge

b Money Market Hedge.

Be sure to carefully label the and axes of your graphs and show the important cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started