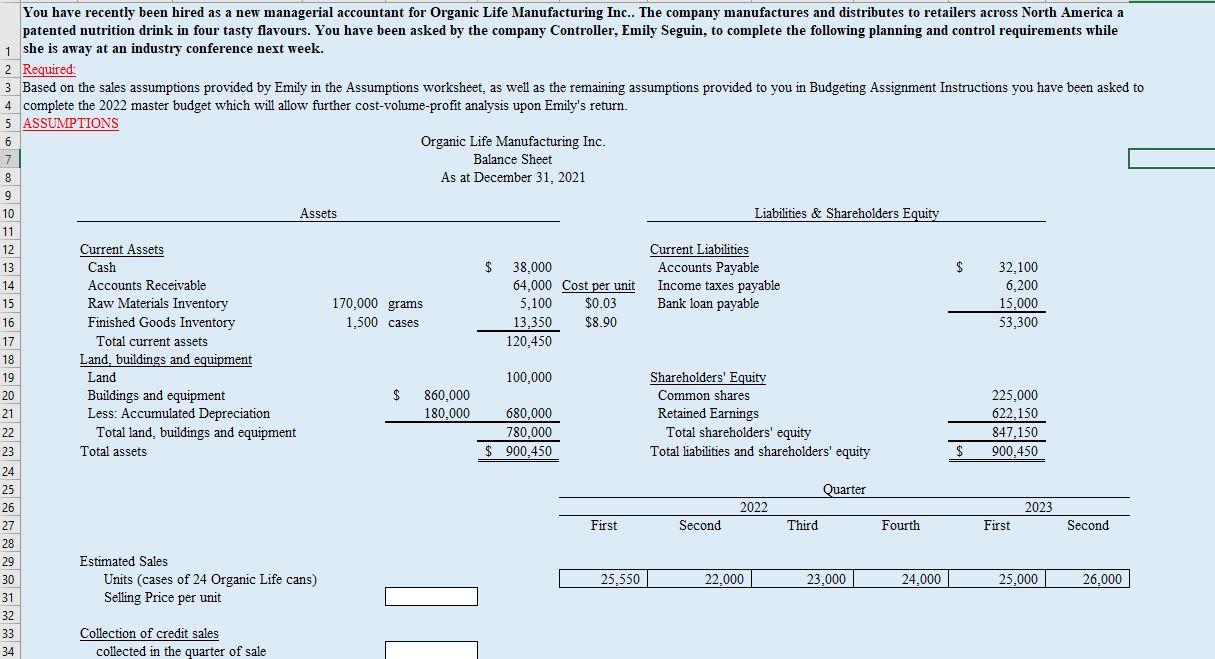

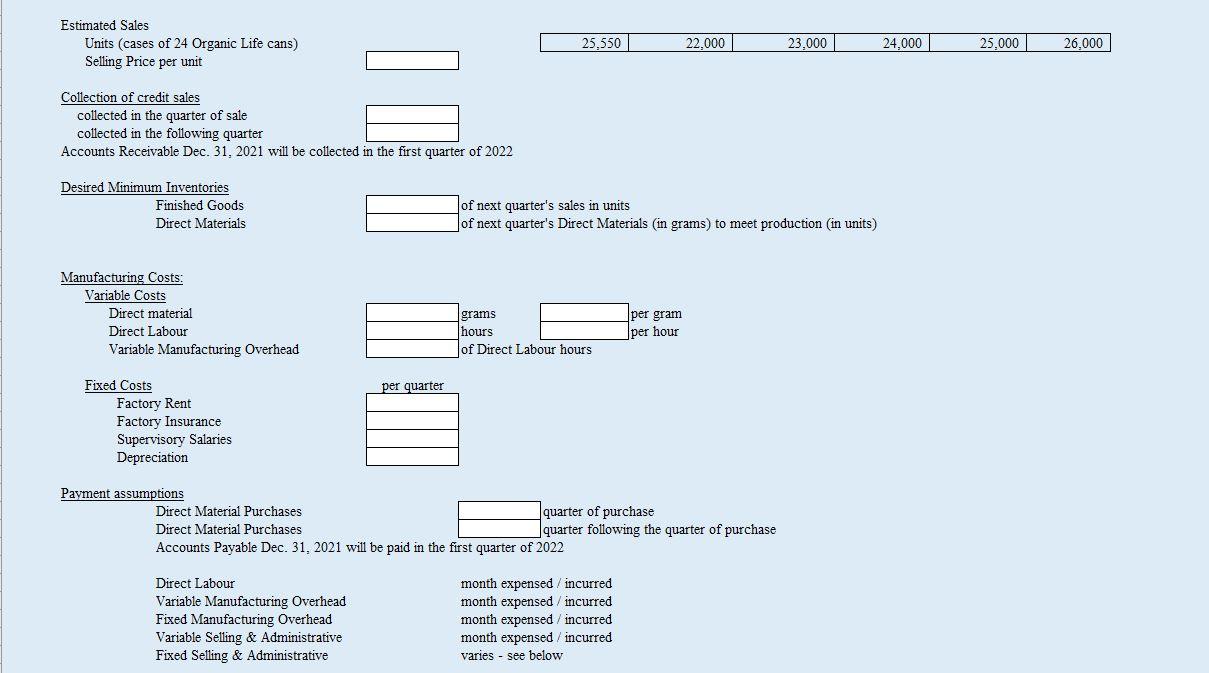

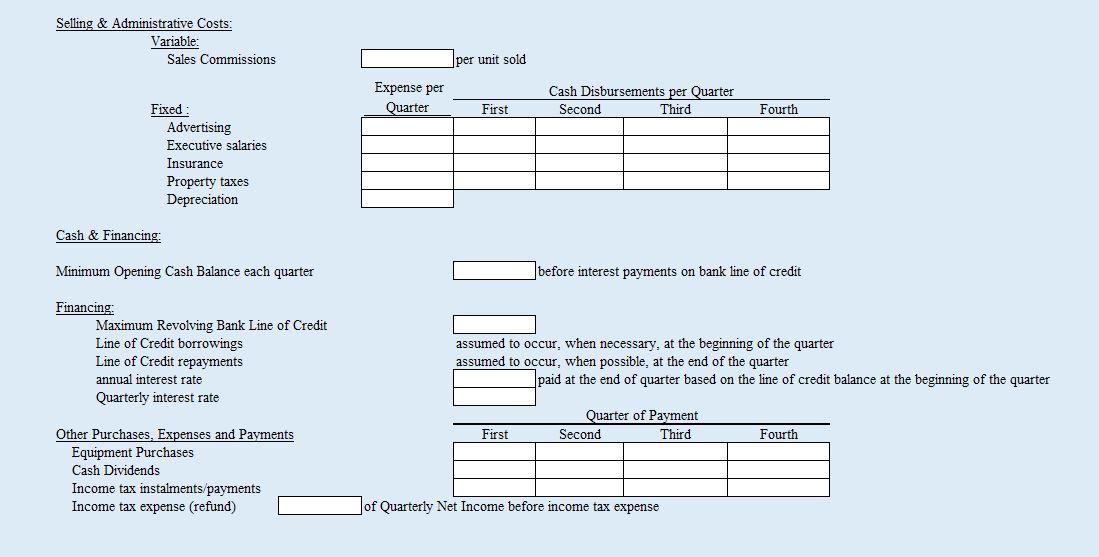

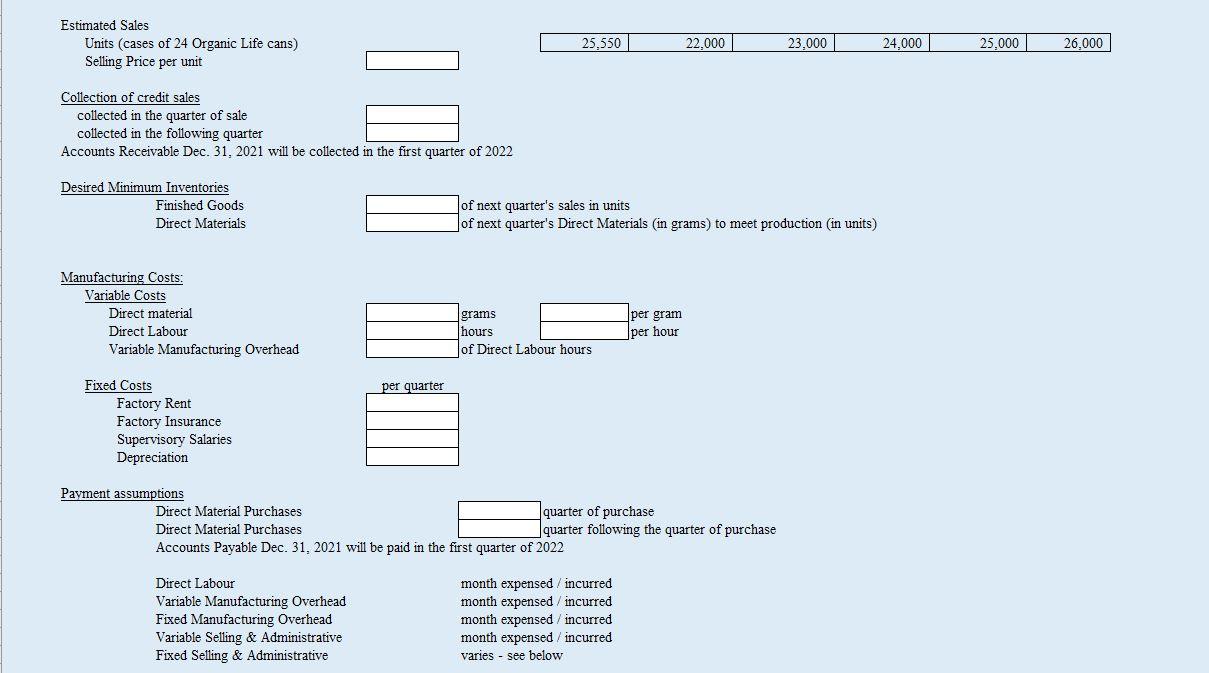

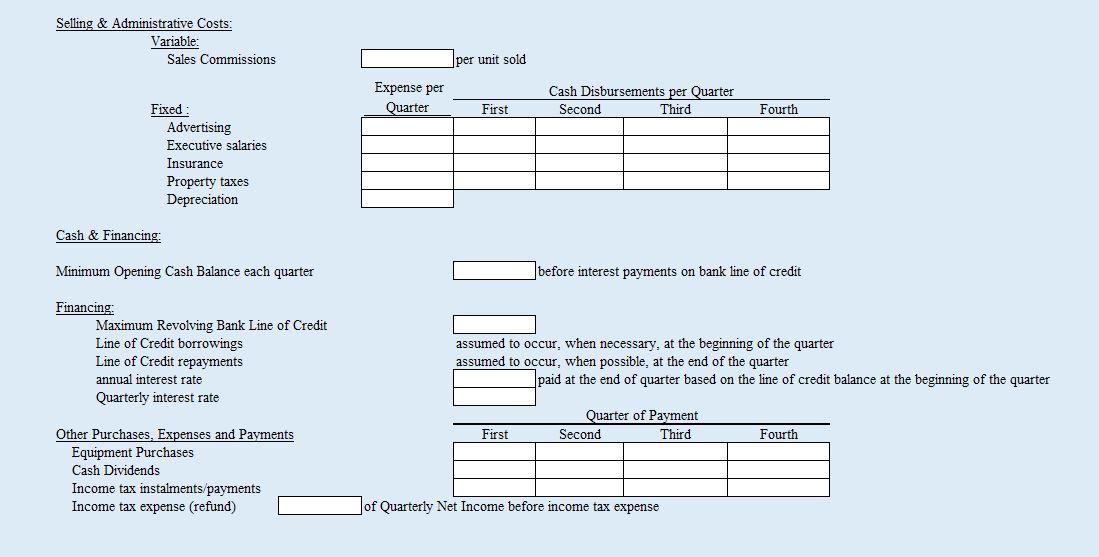

You have recently been hired as a new managerial accountant for Organic Life Manufacturing Inc.. The company manufactures and distributes to retailers across North America a patented nutrition drink in four tasty flavours. You have been asked by the company Controller, Emily Seguin, to complete the following planning and control requirements while 1 she is away at an industry conference next week. 2 Required: 3 Based on the sales assumptions provided by Emily in the Assumptions worksheet, as well as the remaining assumptions provided to you in Budgeting Assignment Instructions you have been asked to 4 complete the 2022 master budget which will allow further cost-volume-profit analysis upon Emily's return. 5 ASSUMPTIONS 6 Organic Life Manufacturing Inc. 7 Balance Sheet 8 As at December 31, 2021 9 10 Assets Liabilities & Shareholders Equity 11 12 Current Assets Current Liabilities 13 Cash $ 38,000 Accounts Payable $ 32,100 14 Accounts Receivable 64,000 Cost per unit Income taxes payable 6,200 15 Raw Materials Inventory 170.000 grams 5,100 $0.03 Bank loan payable 15,000 16 Finished Goods Inventory 1,500 cases 13,350 $8.90 53,300 17 Total current assets 120,450 18 Land, buildings and equipment 19 Land 100,000 Shareholders' Equity 20 Buildings and equipment $ 860,000 Common shares 225,000 21 Less: Accumulated Depreciation 180.000 680.000 Retained Earnings 622,150 22 Total land, buildings and equipment 780,000 Total shareholders' equity 847,150 23 Total assets 900.450 Total liabilities and shareholders' equity $ 900.450 24 25 Quarter 26 2022 2023 27 First Second Fourth First Second 28 29 Estimated Sales 30 Units (cases of 24 Organic Life cans) 25,550 22,000 23,000 24,000 25,000 26,000 31 Selling Price per unit 32 33 Collection of credit sales 34 collected in the quarter of sale Third Estimated Sales Units (cases of 24 Organic Life cans) Selling Price per unit 25,550 22,000 23,000 24,000 25,000 26.000 Collection of credit sales collected in the quarter of sale collected in the following quarter Accounts Receivable Dec. 31, 2021 will be collected in the first quarter of 2022 Desired Minimum Inventories Finished Goods Direct Materials of next quarter's sales in units Jof next quarter's Direct Materials (in grams) to meet production (in units) Manufacturing Costs: Variable Costs Direct material Direct Labour Variable Manufacturing Overhead grams hours of Direct Labour hours per gram per hour per quarter Fixed Costs Factory Rent Factory Insurance Supervisory Salaries Depreciation Payment assumptions Direct Material Purchases quarter of purchase Direct Material Purchases quarter following the quarter of purchase Accounts Payable Dec. 31, 2021 will be paid in the first quarter of 2022 Direct Labour Variable Manufacturing Overhead Fixed Manufacturing Overhead Variable Selling & Administrative Fixed Selling & Administrative month expensed / incurred month expensed / incurred month expensed / incurred month expensed / incurred varies - see below Selling & Administrative Costs: Variable: Sales Commissions per unit sold Expense per Quarter Cash Disbursements per Quarter Second Third First Fourth Fixed Advertising Executive salaries Insurance Property taxes Depreciation Cash & Financing: Minimum Opening Cash Balance each quarter before interest payments on bank line of credit Financing Maximum Revolving Bank Line of Credit Line of Credit borrowings Line of Credit repayments annual interest rate Quarterly interest rate assumed to occur, when necessary, at the beginning of the quarter assumed to occur, when possible. at the end of the quarter paid at the end of quarter based on the line of credit balance at the beginning of the quarter Quarter of Payment Second Third First Fourth Other Purchases. Expenses and Payments Equipment Purchases Cash Dividends Income tax instalments/payments Income tax expense (refund) of Quarterly Net Income before income tax expense