Answered step by step

Verified Expert Solution

Question

1 Approved Answer

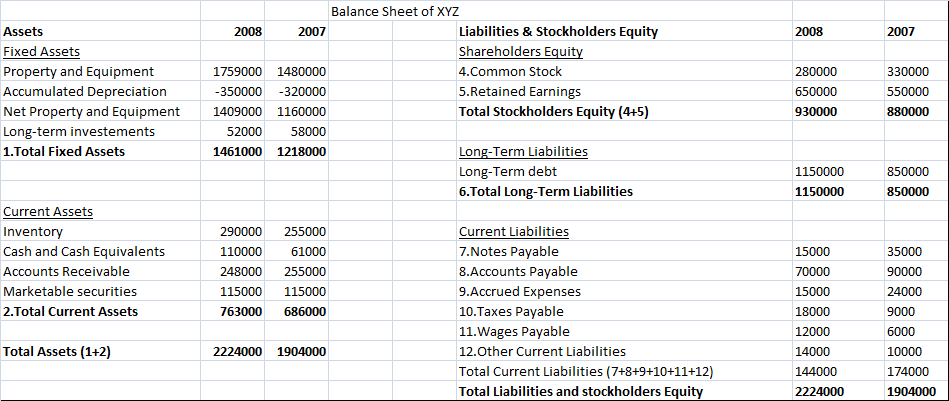

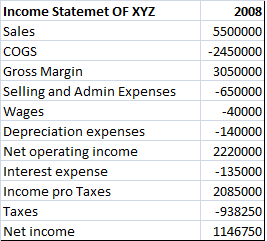

You have the following balance sheets of XYZ for 2008, 2007. All amounts are expressed in Euro. We also have the income statement for 2008.

You have the following balance sheets of XYZ for 2008, 2007. All amounts are expressed in Euro.

We also have the income statement for 2008.

How can you make the cash flow for indirect method (bearing in mind that XYZ has repurchased stocks and it has decreased respectively its share capital) and compute the Dividend payout ratio for 2008?

Balance Sheet of XYZ Assets Fixed Assets Property and Equipment Accumulated Depreciation Net Property and Equipment Long-term investements 1.Total Fixed Assets Liabilities & Stockholders Equity Shareholders Equi 4.Common Stock 5.Retained Earnings Total Stockholders Equity (4+5) 2008 2007 2008 2007 1759000 1480000 350000320000 1160000 5200058000 1461000 1218000 330000 650000 550000 1409000 930000 Long-Term Liabilities Long-Term debt 6.Total Long-Term Liabilities 1150000 1150000 850000 Current Assets Invento Cash and Cash Equivalents Accounts Receivable Marketable securities 2.Total Current Assets Current Liabilities 7.Notes Payable 8.Accounts Payable 9.Accrued Expenses 10.Taxes Payable 11.Wages Payable 12.Other Current Liabilities Total Current Liabilities (7+8+9+10+11+12) Total Liabilities and stockholders Equity 290000255000 110000 61000 248000 255000 115000 115000 763000 686000 70000 15000 18000 12000 14000 144000 2224000 90000 24000 9000 6000 10000 174000 1904000 Total Assets (1+2) 2224000 1904000 Income Statemet OF XYZ Sales COGS Gross Margin 2008 2450000 urxxi Selling and Admin Expenses 650000 Wages Depreciation expenses Net operating income Interest expense Income pro Taxes Taxes Net income -40000 1AAKKK) 2085000 938250 1146750Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started